Company Comparison Excel Tools – A worked example

We have updated our Tobacco Transformation Index Company Comparison Excel Tools to provide a broader view of an Index Company’s position relative to its peers. In this blog post, we use Imperial Brands to illustrate how a company might use our Excel Tools to analyse its 2022 Tobacco Transformation Index results and evaluate the most feasible opportunities for score and ranking improvement.

Although Imperial’s overall ranking was unchanged at fifth, it recorded the most significant score decline in the Index.

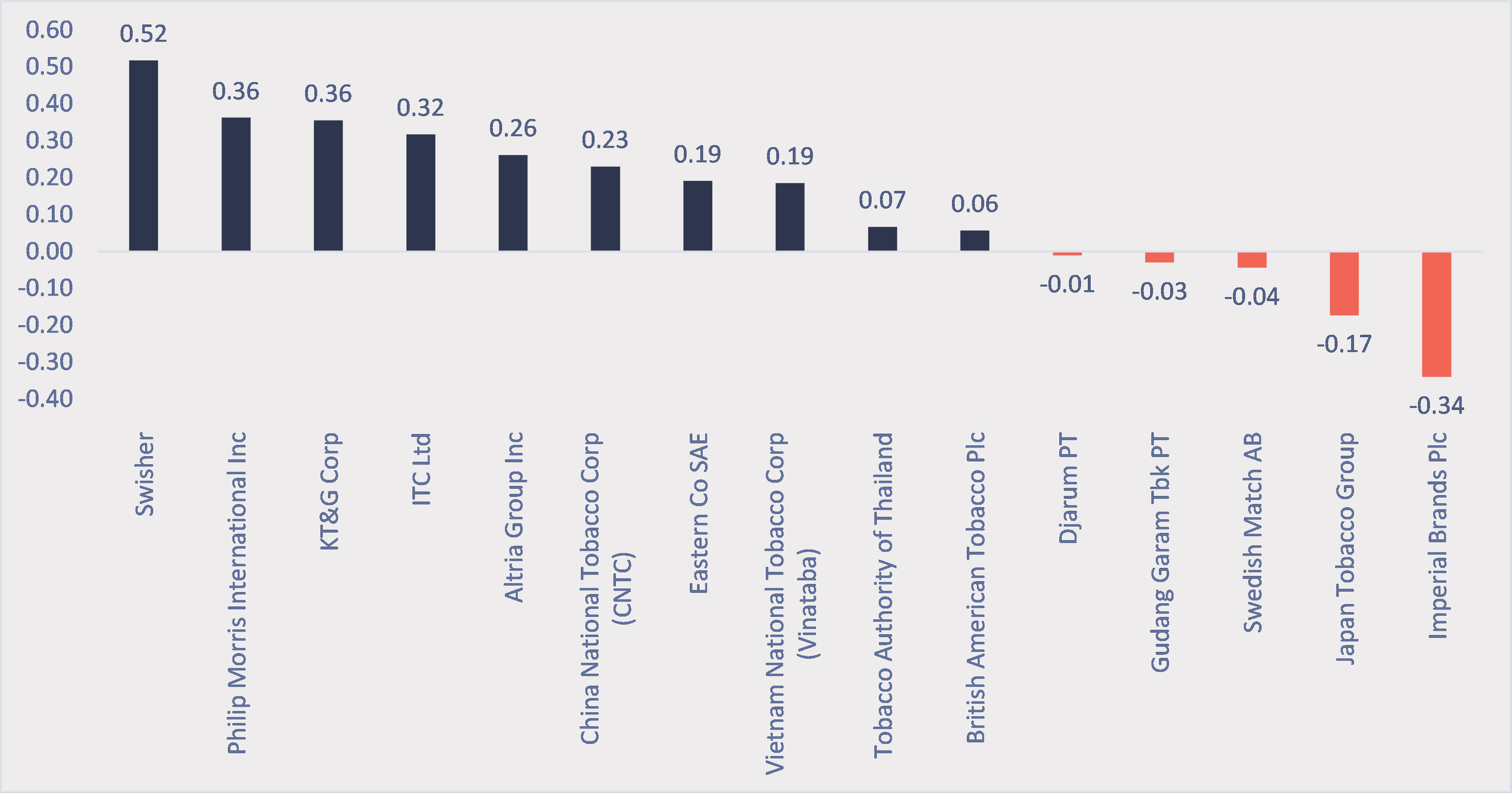

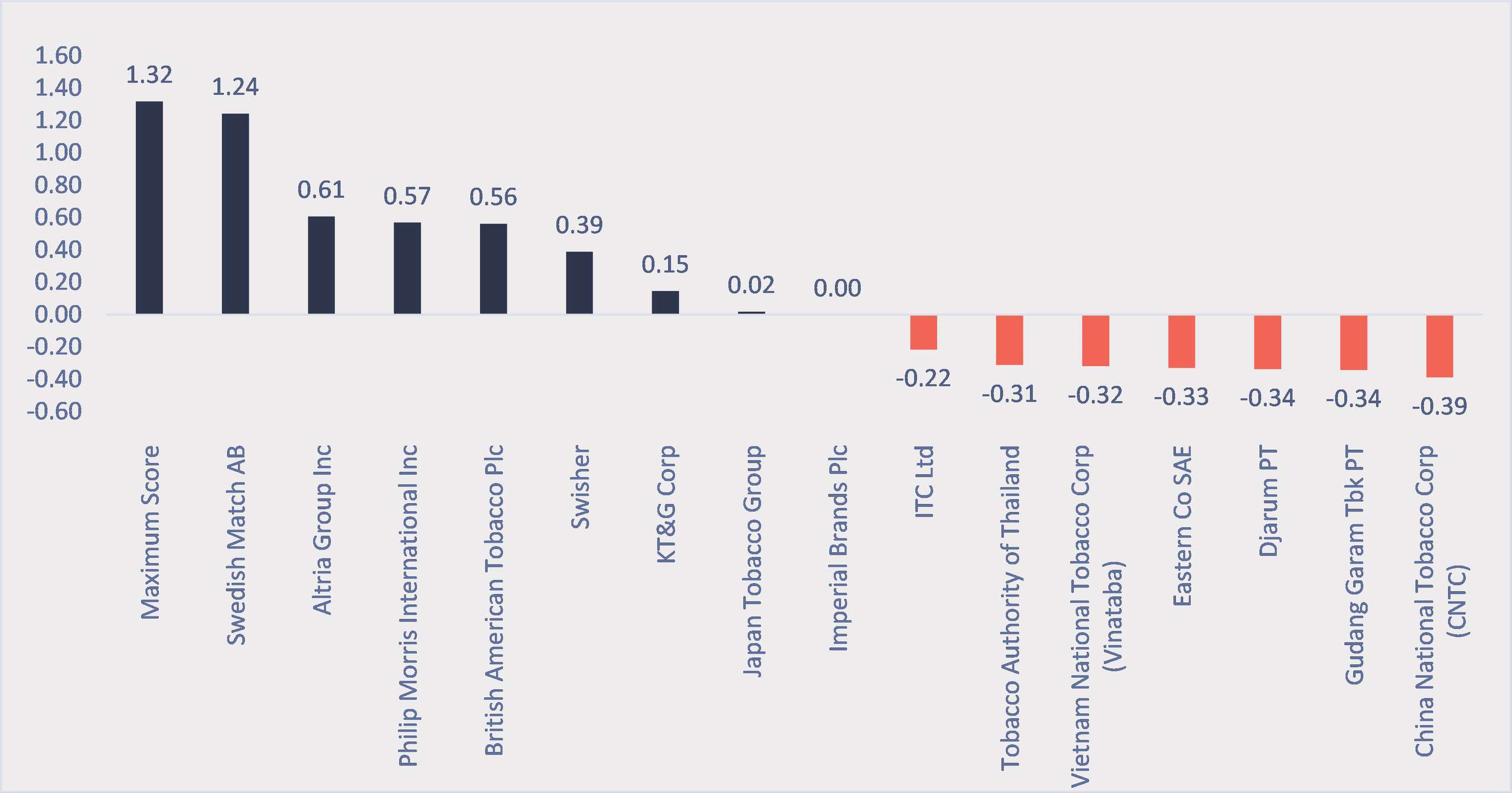

Final Score Change

Source: Tobacco Transformation Index

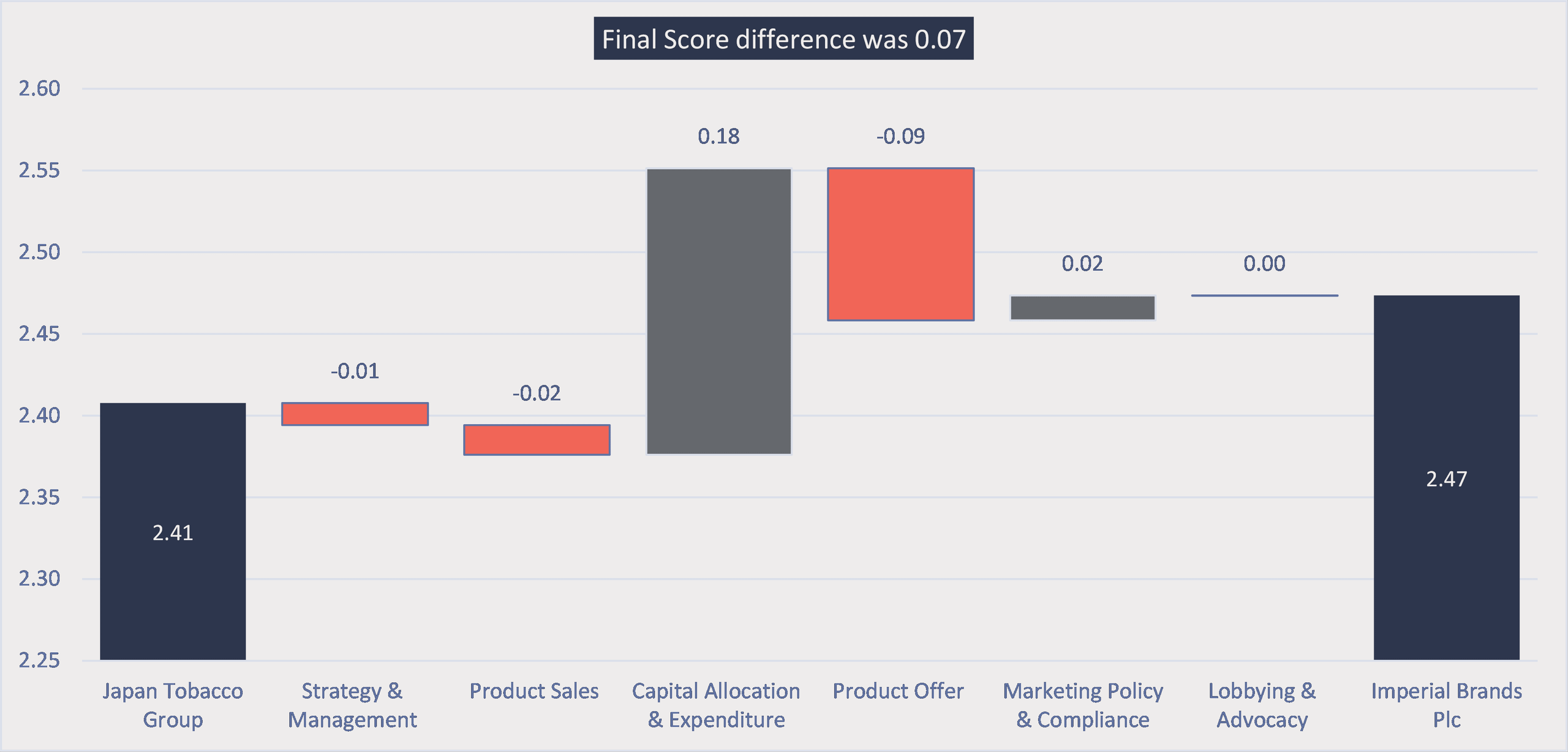

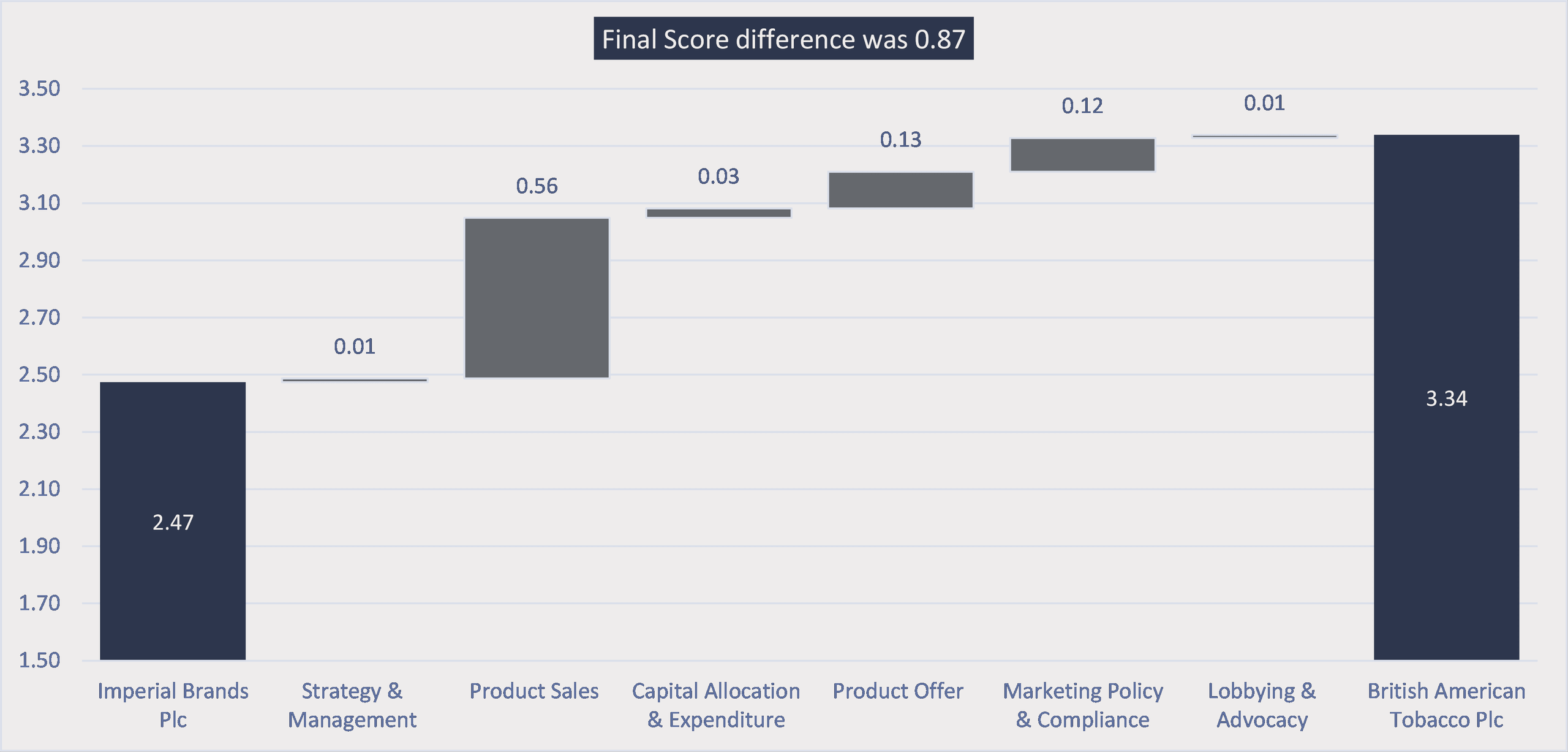

Its Final Score of 2.47 was only 0.07 higher than sixth-ranked

Japan Tobacco, but 0.87 lower than fourth-ranked BAT.

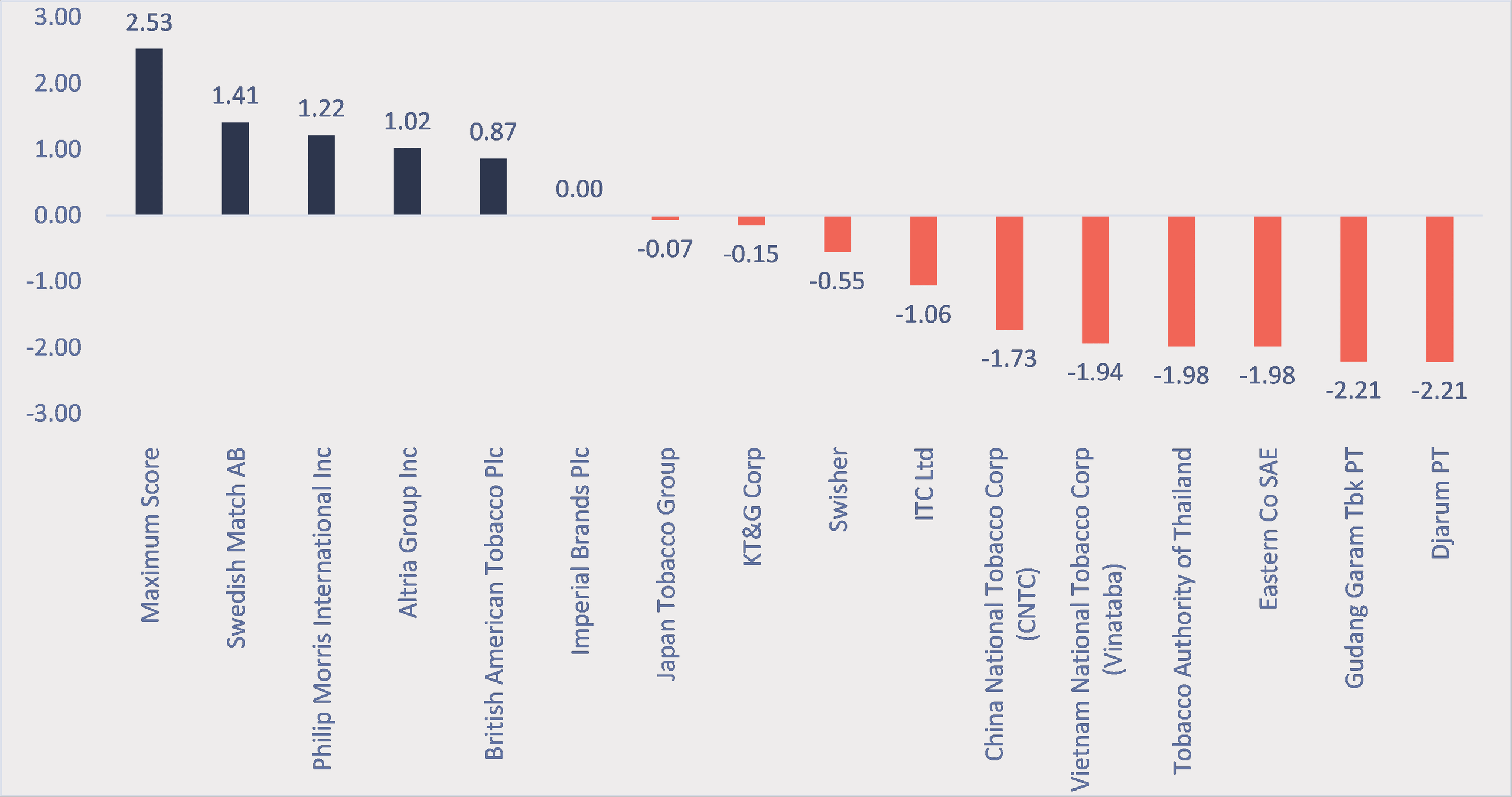

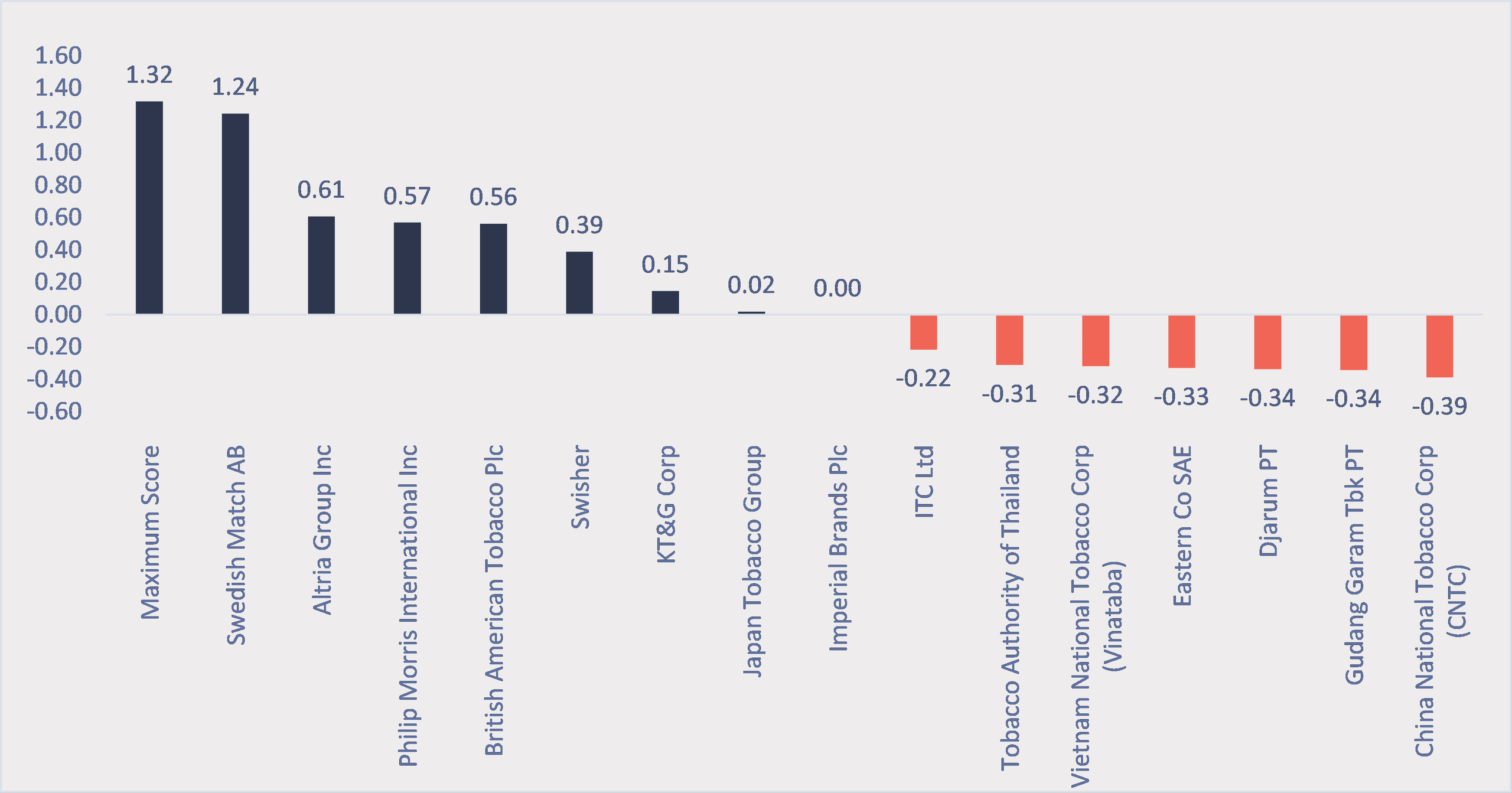

Final Score Scores differences with Imperial Brands Plc (2.47)

Source: Tobacco Transformation Index, Idwala Research

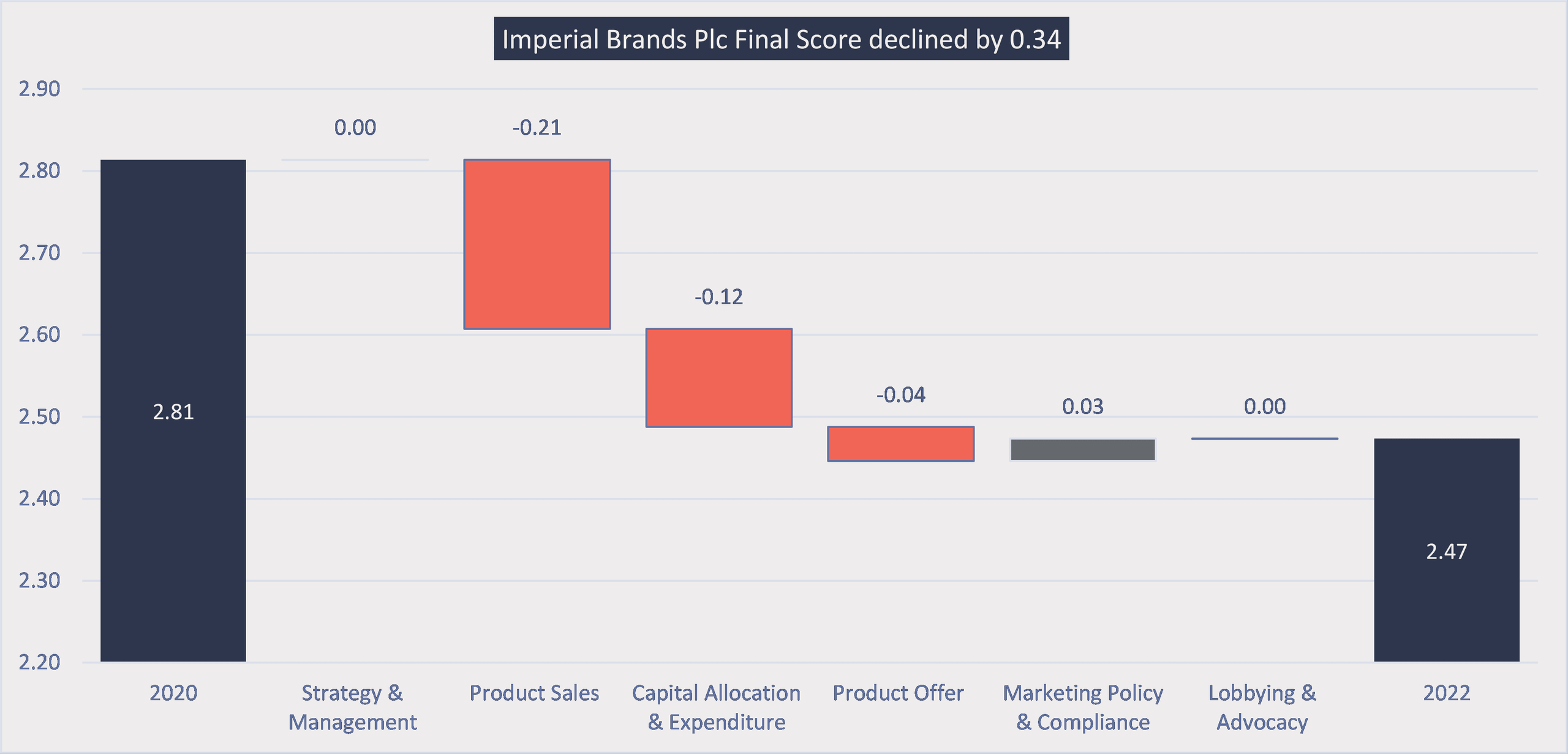

The most significant category contributors to Imperial’s

score decline were Product Sales and Capital Allocation and Expenditure.

Category contribution to Imperial Brands Plc Final Score change

Source: Tobacco Transformation Index, Idwala Research

In Product Sales, Imperial also recorded the most

significant score decline (-0.21). The chart below shows the difference between

Imperial’s Product Sales Score change and those of its peers, e.g. Japan

Tobacco’s score decline was 0.04 less than Imperial’s and KT&G’s 0.13.

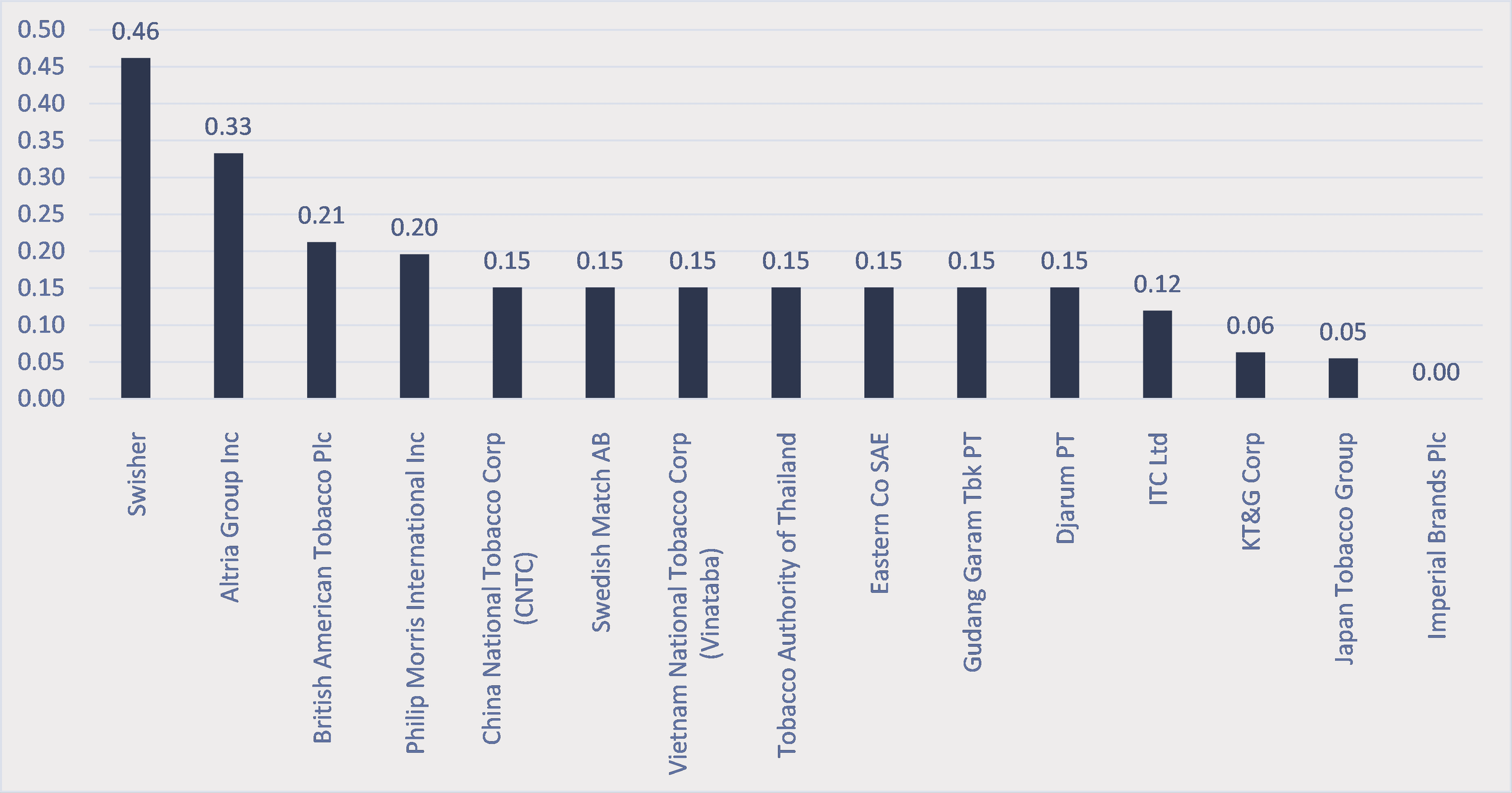

Product Sales Score changes relative to Imperial Brands Plc (-0.21)

Source: Tobacco Transformation Index, Idwala Research

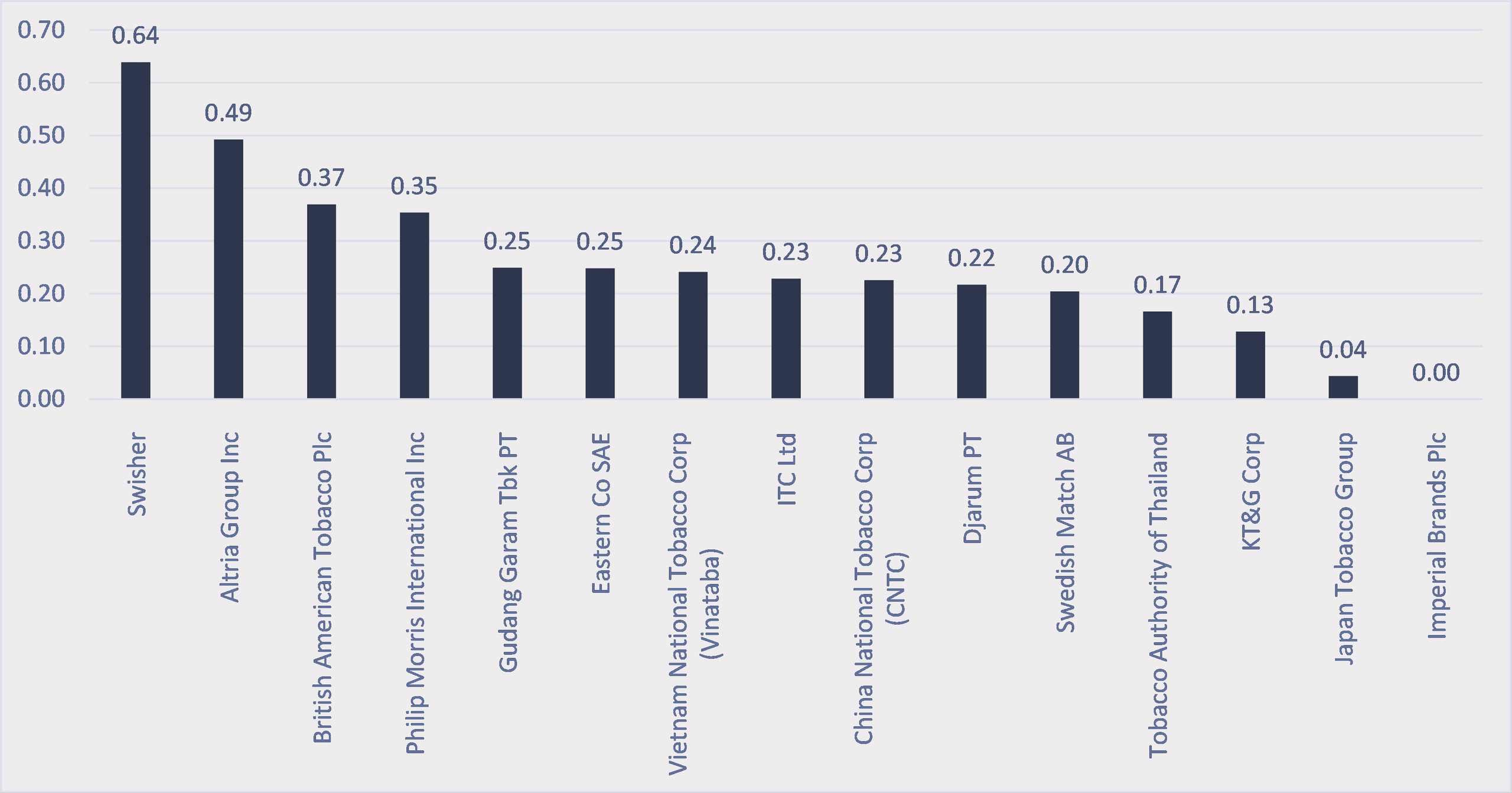

The relative Product Sales score changes have left Imperial’s

score now modestly below JT Group, with reduced leads over those ranked below

it and more significant gaps with those ranked higher.

Product Sales Score differences with Imperial Brands Plc (0.43)

Source: Tobacco Transformation Index, Idwala Research

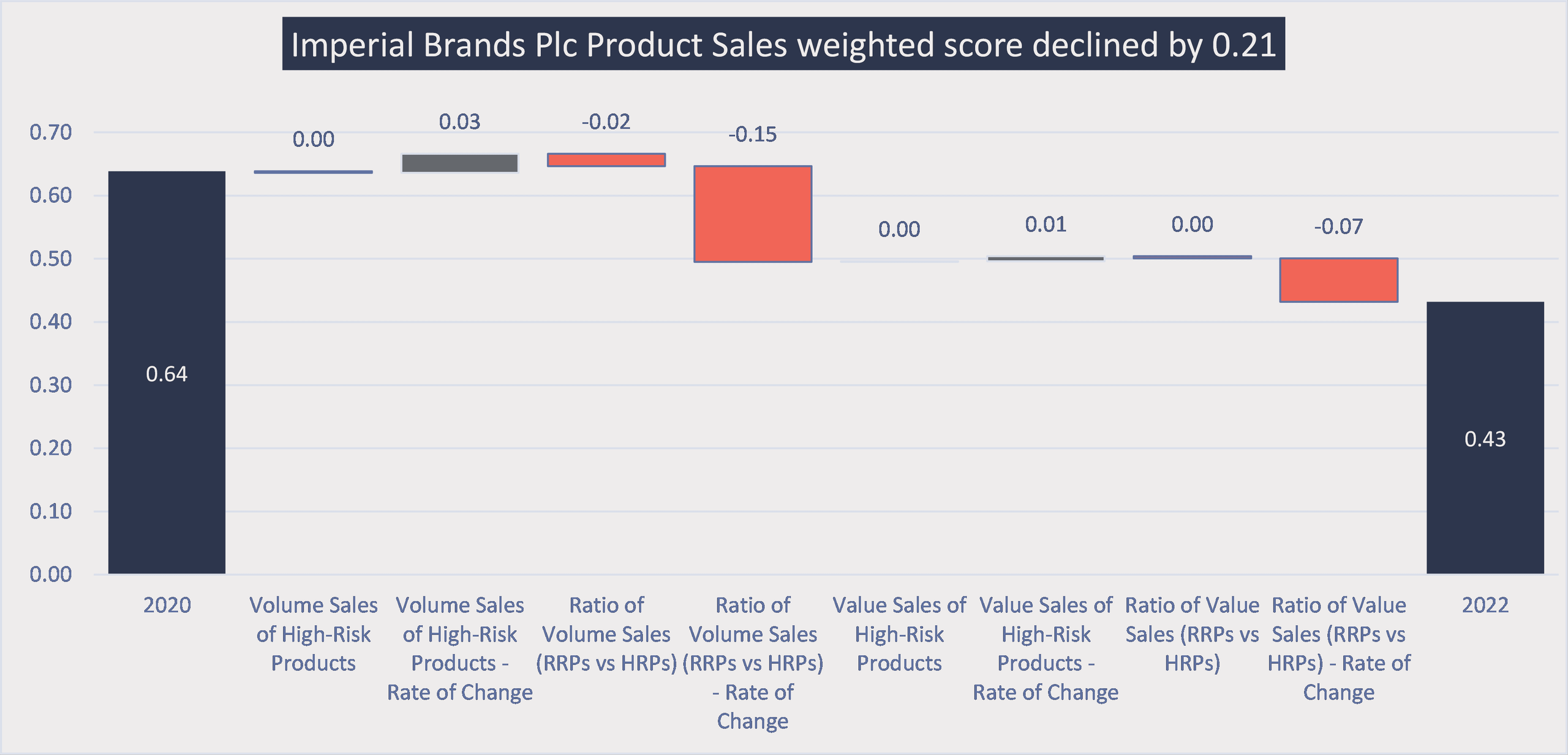

The RRP/HRP ratio rate of change indicators were the main

drivers of Imperial’s 0.21 Product Sales weighted score decline. The rate of

decline in the volume ratio was the most significant contributor, as shown in

the chart below. These declines followed a strategic decision by the company to

withdraw its closed-system vaping product from Russia and Japan and its heated

tobacco product from Japan.

Indicator contribution to Imperial Brands Plc Product Sales weighted score change

Source: Tobacco Transformation Index, Idwala Research

Imperial’s 0.15 weighted score decline in this indicator was

also the biggest in the Index, with JT Group, KT&G and ITC recording more

modest declines, as shown in the chart below.

Ratio of Volume Sales (RRPs vs HRPs) - Rate of Change Score changes relative to Imperial Brands Plc (-0.15)

Source: Tobacco Transformation Index, Idwala Research

Considering that Imperial’s score for this indicator

declined by 0.15, its 2022 score of 0.10 is within striking distance of those

who scored zero ranked below it and 2-3 of those who were ranked higher. (chart

below)

Ratio of Volume Sales (RRPs vs HRPs) - Rate of Change Score differences with Imperial Brands Plc (0.10)

Source: Tobacco Transformation Index, Idwala Research

Peer-to-peer comparison

Imperial may compare itself ranked closest to it to establish what would be required to improve its ranking or where it is most vulnerable to a lower ranking.

Comparison to Japan Tobacco Group

In 2022, Imperial’s Final Score was 0.07 higher than JT Group’s. Capital Allocation & Expenditure (0.18) was the most significant contributor, partly offset by Product Offer (-0.09).

Category contribution to Final Score difference: Japan Tobacco Group & Imperial Brands Plc

Source: Tobacco Transformation Index, Idwala Research

*Figures don't match owing to rounding

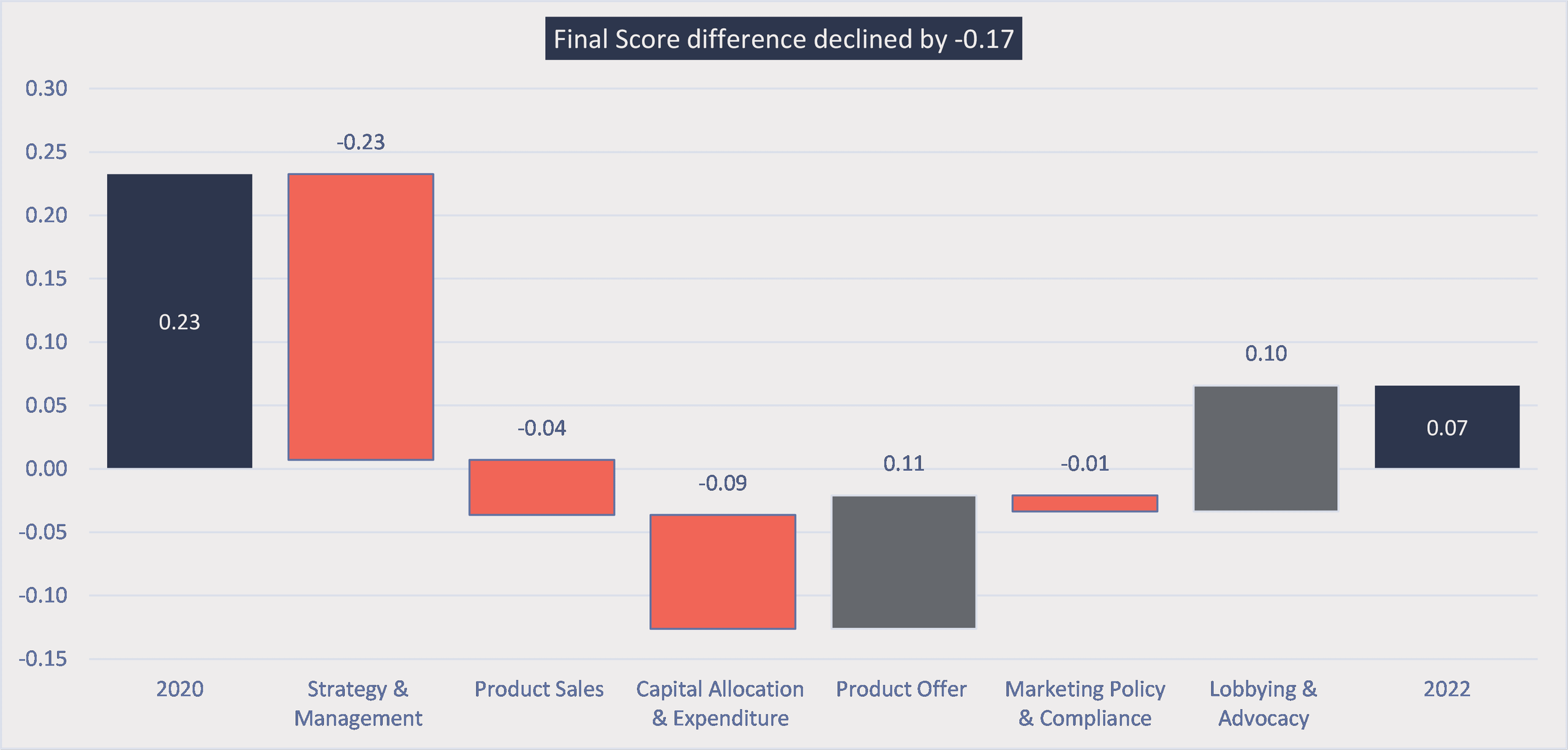

From 2020 to 2022, the Final Score difference between

Imperial and JT Group declined by a substantial 0.17, mainly because JT Group improved

its Strategy & Management Score and recorded lower score reductions than

Imperial in Product Sales and Capital Allocation & Expenditure. Partly

offsetting these were a lower score reduction for Imperial in Product Offer and

a score decline in Lobbying & Advocacy for JT Group.

Category contribution to change in Final Score difference: Imperial Brands Plc less Japan Tobacco Group

Source: Tobacco Transformation Index, Idwala Research

*Figures don't match owing to rounding

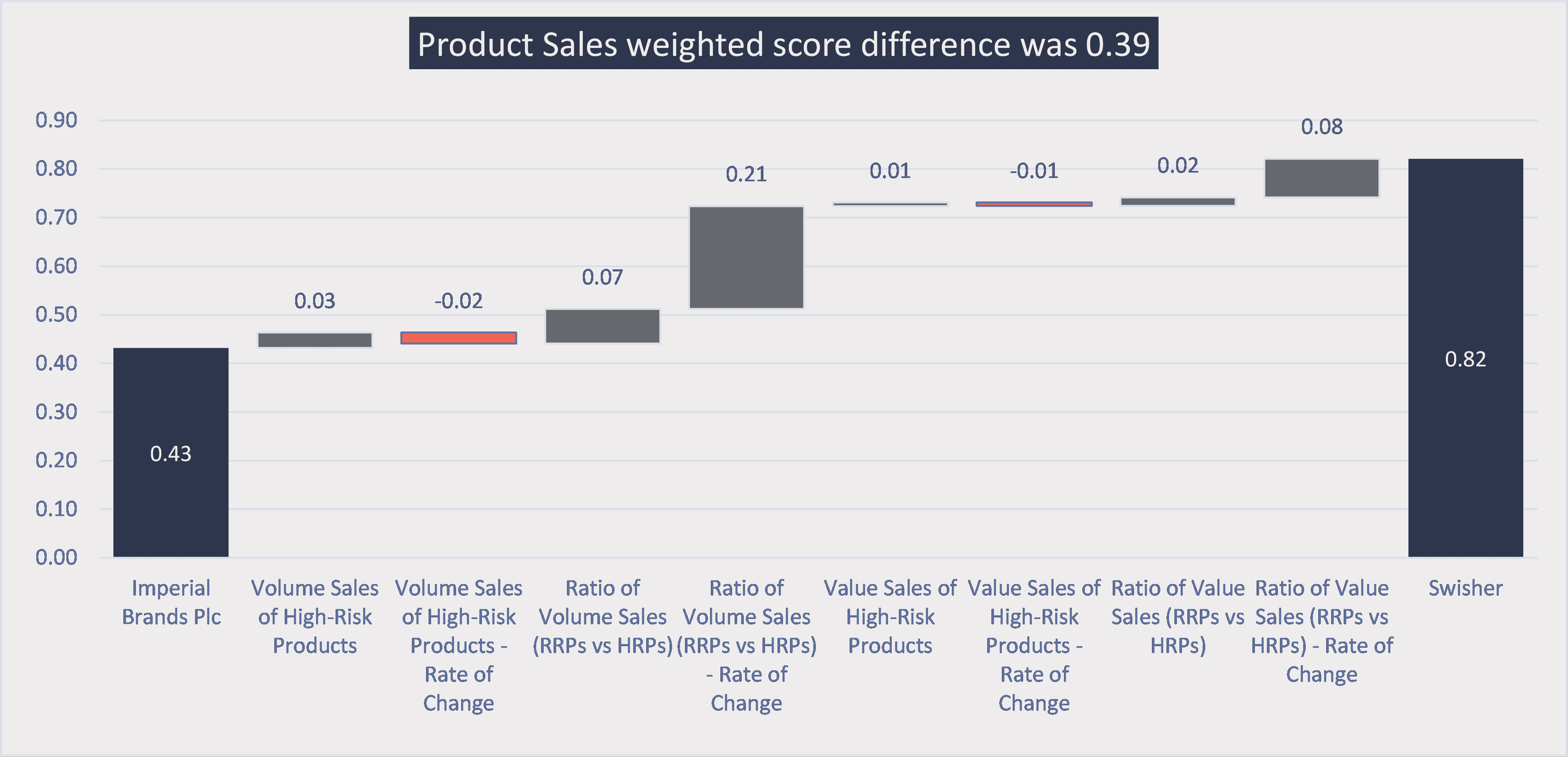

Comparison to Swisher on Product Sales

Whereas the Product Sales category was the most significant contributor to Imperial’s lower score, it accounted for most of Swisher’s Final Score increase.

In 2022, Swisher’s Product Sales weighted score of 0.82 was 0.39 higher than Imperial’s 0.43. The RRP/HRP ratio indicators, particularly the rate of change, were the most significant contributors to this score difference.

Indicator contribution to Product Sales weighted score difference: Imperial Brands Plc & Swisher

Source: Tobacco Transformation Index, Idwala Research

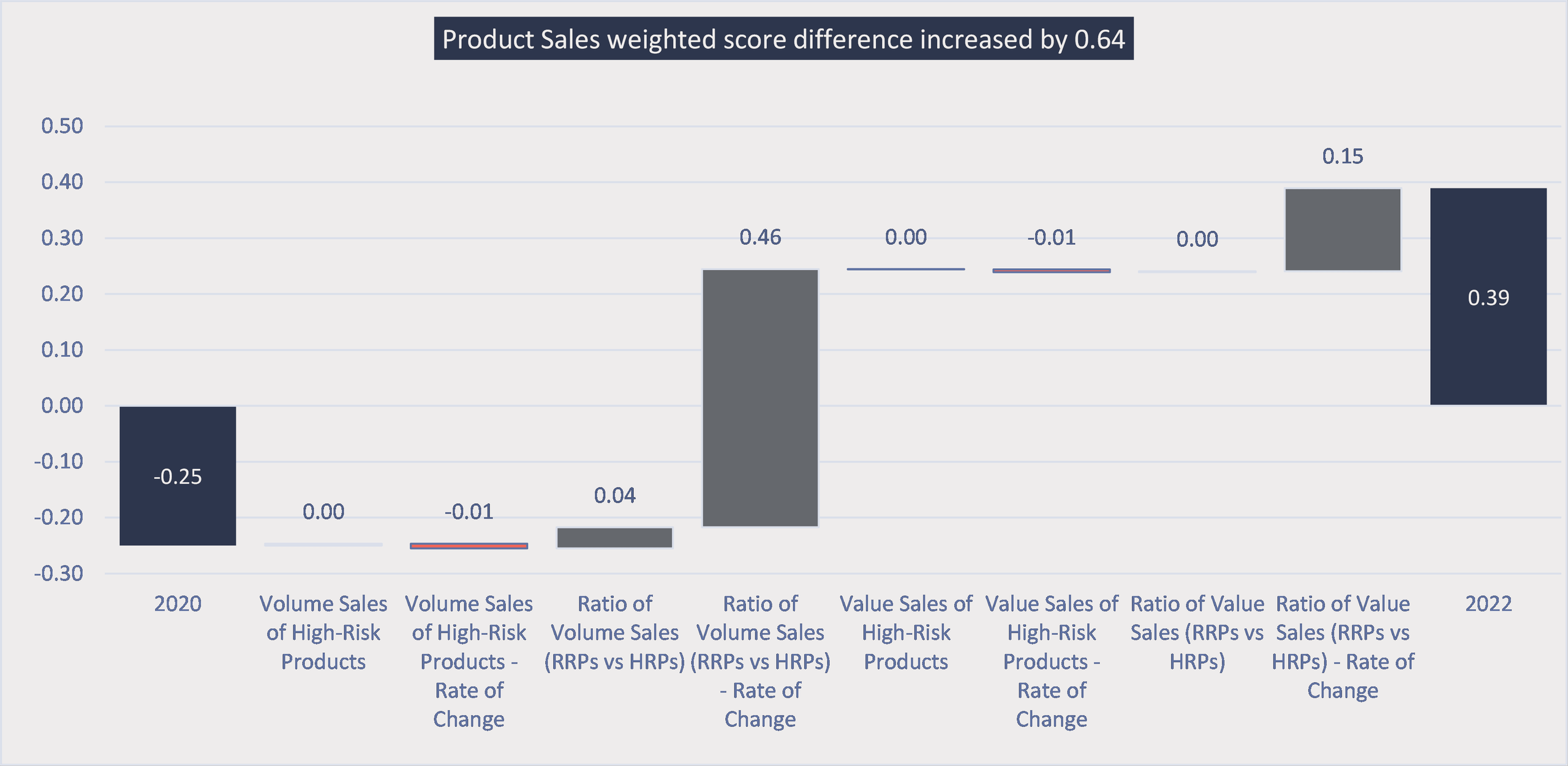

Their Product Sales weighted score difference increased substantially

by 0.64 as Swisher moved ahead of Imperial in the category. The most

significant driver was the rate of change of the RRP/HRP volume ratio.

Indicator contribution to change in Product Sales weighted score difference: Swisher less Imperial Brands Plc

Source: Tobacco Transformation Index, Idwala Research

The Product Sales category

comparison between Imperial and Swisher shows some important dynamics regarding

the calculation of the Index.

- Swisher’s category score benefitted from the first-time inclusion of Rogue nicotine pouch volumes and the low relative risk attached to these products.

- Imperial’s score was negatively affected by a strategic decision by the company to withdraw its closed-system vaping product from Russia and Japan and its heated tobacco product from Japan.

- However, since scoring is relative, even if Imperial did nothing, its category score would likely have declined owing to significantly improved metrics reported by Swisher and other peers, notably Altria.

- Similarly, Swisher’s score likely benefitted from Imperial reporting weaker Product Sales metrics.

How can Imperial get closer to BAT?

Product Sales, Product Offer and Marketing Policy & Compliance make up most of the 0.87 Final Score difference between Imperial and BAT, with Product Sales the most significant contributor.

Category contribution to Final Score difference: Imperial Brands Plc & British American Tobacco Plc

Source: Tobacco Transformation Index, Idwala Research

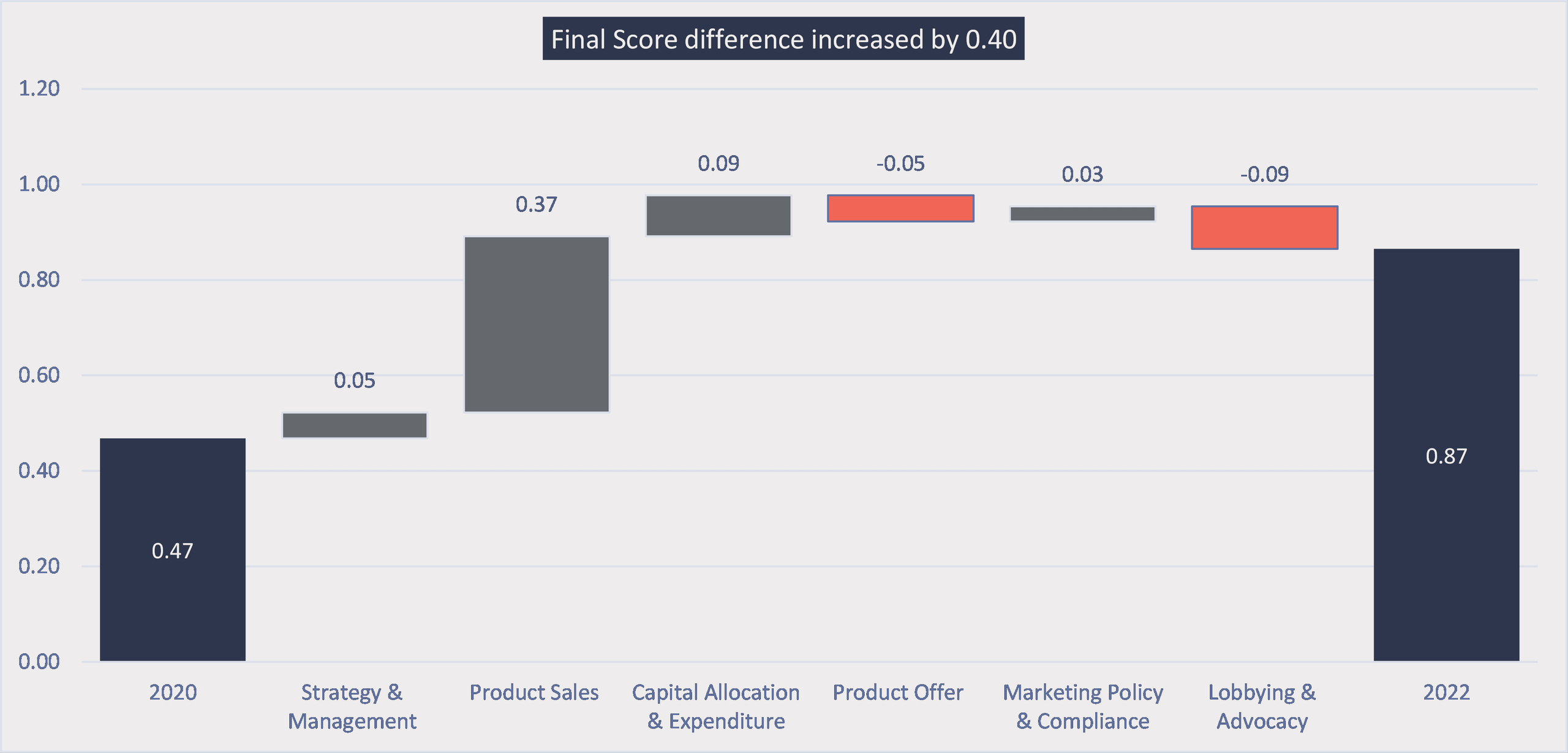

From 2020 to 2022, the Final Score difference between BAT

and Imperial nearly doubled, from 0.47 to 0.87, with Product Sales also

accounting for most of the increase.

Category contribution to change in Final Score difference: British American Tobacco Plc less Imperial Brands Plc

Source: Tobacco Transformation Index, Idwala Research

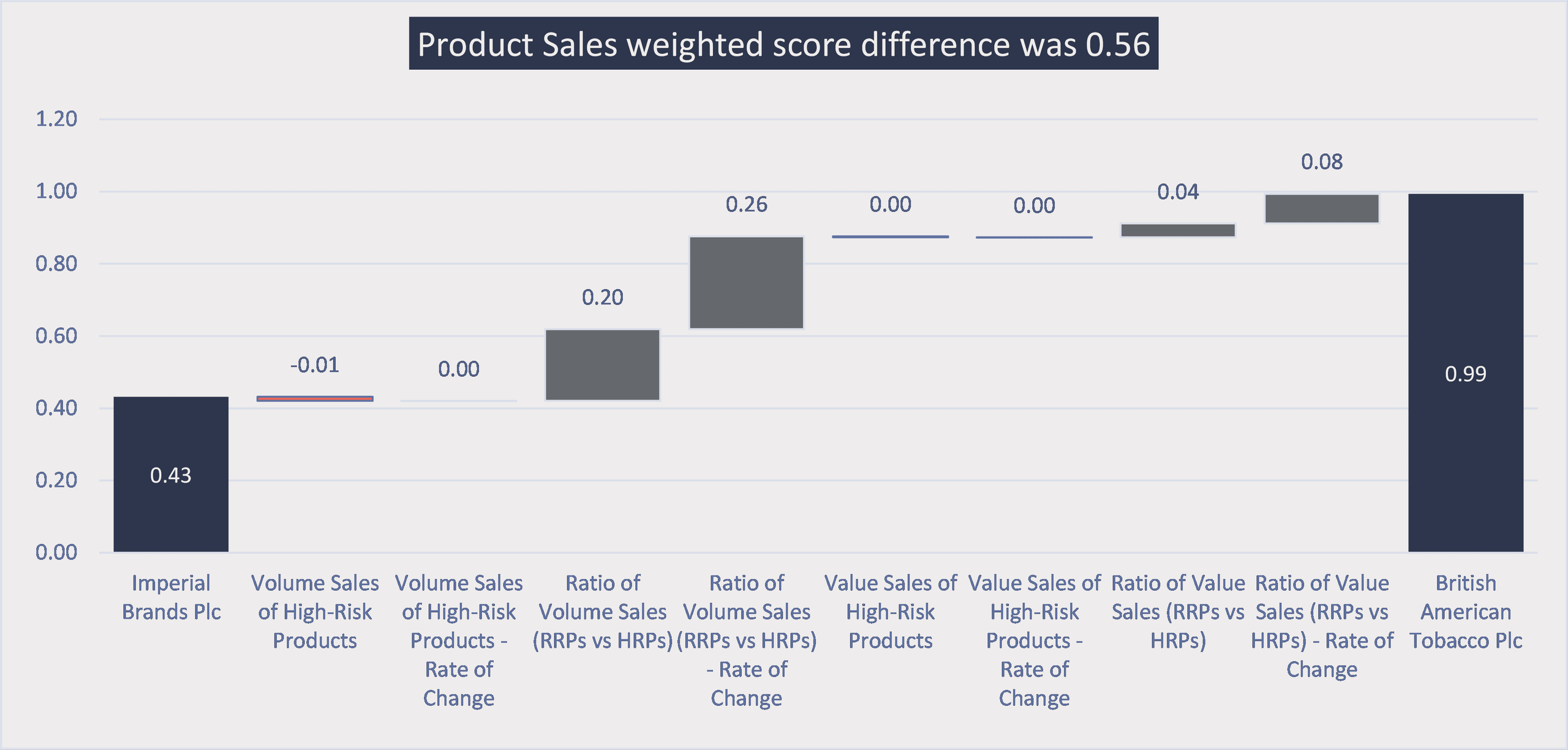

If we narrow the focus to Product Sales, it is clear that the

four RRP/HRP ratio indicators accounted for the 0.56 score difference between

the two companies.

Indicator contribution to Product Sales weighted score difference: Imperial Brands Plc & British American Tobacco Plc

Source: Tobacco Transformation Index, Idwala Research

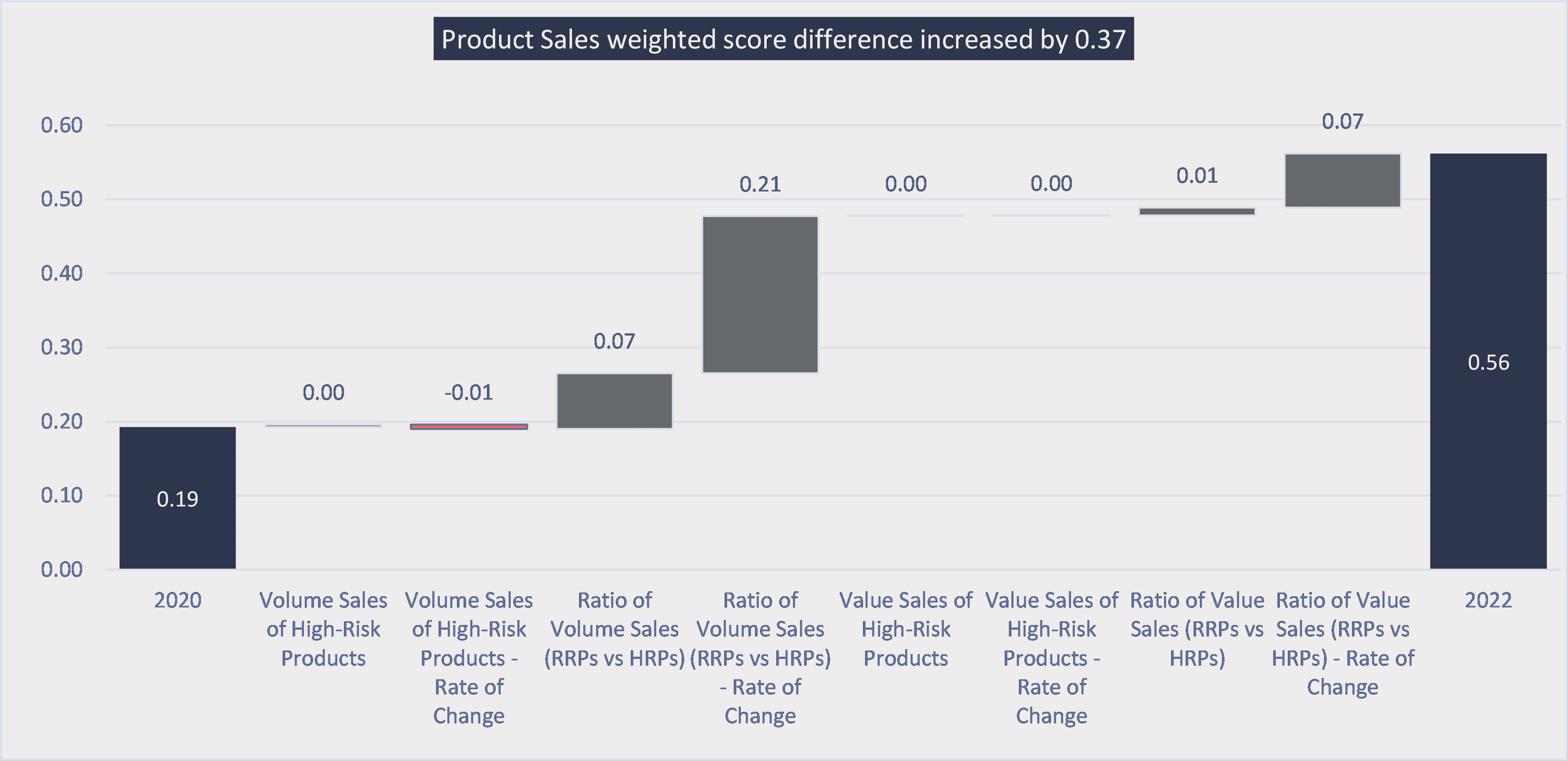

Whilst there was a significant score difference in the

Product Sales category in 2022, this was not the case in the 2020 Index when it

was 0.19.

Indicator contribution to change in Product Sales weighted score difference: British American Tobacco Plc less Imperial Brands Plc

Source: Tobacco Transformation Index, Idwala Research

The 0.37 increase in their weighted score difference again

came from the four RRP/HRP ratio indicators, with more than half (0.21) contributed

by the RRP/HRP volume ratio rate of change indicator. More than 80% of this

indicator’s 2022 0.26 score difference resulted from the increase in its score

difference from 2020.

Imperial’s score in this indicator declined by 0.15, and BAT’s increased by 0.06, with Imperial’s score negatively affected by a combination of its decision to withdraw its closed-system vaping product from Russia and Japan and its heated tobacco product from Japan and improved scores from its Index peers. BAT’s score increase reflects an increase in its RRP volume contribution from 6.6% to 10.0% over the Index review period. For Imperial to improve its score and narrow the gap with peers, it needs to expand its RRP business and grow its contribution at a faster rate than the rest of the Index.

Idwala Research Limited produced these reports and Excel tools pursuant to a professional services agreement with the Foundation for a Smoke-Free World, Inc. The opinions expressed herein are the author’s sole responsibility and under no circumstances shall be regarded as reflecting the positions of the Foundation for a Smoke-Free World, Inc. Pieter Vorster, Managing Director of Idwala Research Limited, served on the Index Technical Committee for the 2022 Tobacco Transformation Index.