The Tobacco Transformation Index – What’s in it for the industry?

In our view, the Tobacco Transformation Index

offers a framework that can help tobacco companies broaden their investor base

to include ESG investors seeking engagement opportunities. We urge the industry

to embrace this tool for maximum impact and discuss why in this blog.

We have also updated our Company Comparison Excel Tools to provide a broader view of an Index Company’s position relative to its peers. In a separate blog post, we provide a worked example of how a company might use these Excel tools to analyse its Tobacco Transformation Index results and position.

Investors already recognise RRP sales contributions

There are clear incentives for tobacco companies, especially those listed on public markets, to embrace and accelerate their transformation to reduced-risk products (RRPs). A more sustainable long-term business model, combined with higher growth, should significantly enhance valuations as investors apply higher multiples based on improved growth and assume longer competitive advantage periods and higher terminal values in their valuations.

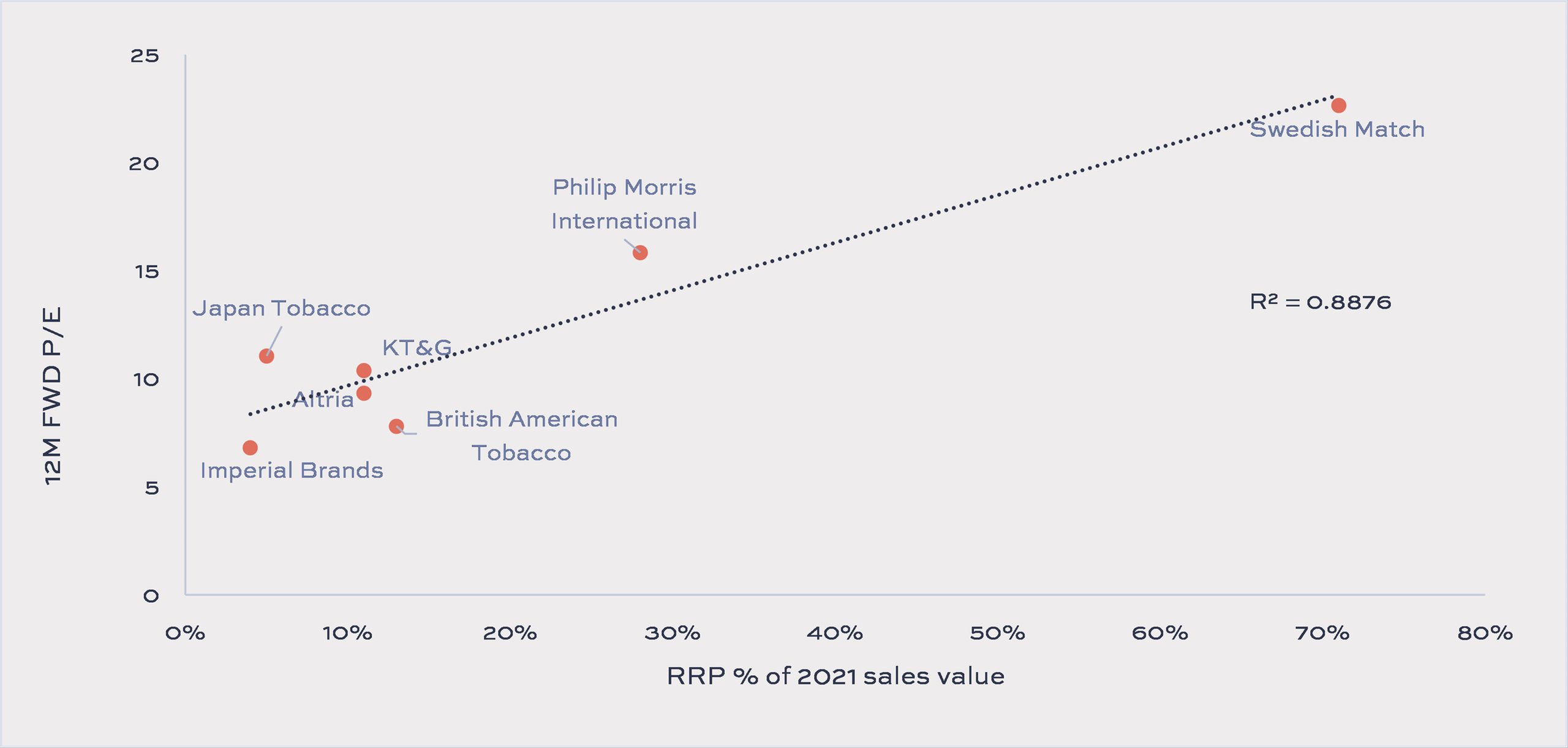

Most large listed tobacco companies have introduced RRPs, albeit with varying degrees of success and commitment to transformation. It is clear, though, that investors are rewarding those with a more significant proportion of sales revenue from RRPs with higher valuation multiples.

Figure 1: 12-month forward P/E v. RRP contribution to 2021 sales value

Source: Tobacco Transformation Index, Idwala Research. Priced as of close 10 February 2023. Swedish Match share price and estimates as of 30 December 2022

The fact that investors appear to recognise companies’ transformation efforts insofar as they impact revenues, rather than volumes and broader transformation metrics related to commitment, performance and transparency as measured by the Tobacco Transformation Index, may lead some in the industry to question the incremental utility of the Index for them.

So, what’s in it for the industry?

Potentially a great deal, in our view. Since Calpers made headlines for divesting from the tobacco sector in 2000, a growing number of funds and fund managers have excluded the sector from portfolios. Tobacco Free Portfolios was founded in 2010 and, in 2018, expanded its reach with the launch of The Tobacco-Free Finance Pledge in collaboration with several UN bodies and financial institutions. The pledge currently has 195 signatories representing assets under management of US$16.6 trillion out of around $100 trillion managed by the global asset management industry. Documentation from the organisation suggests that it has influenced a shift of some US$20 billion away from investment in tobacco companies.

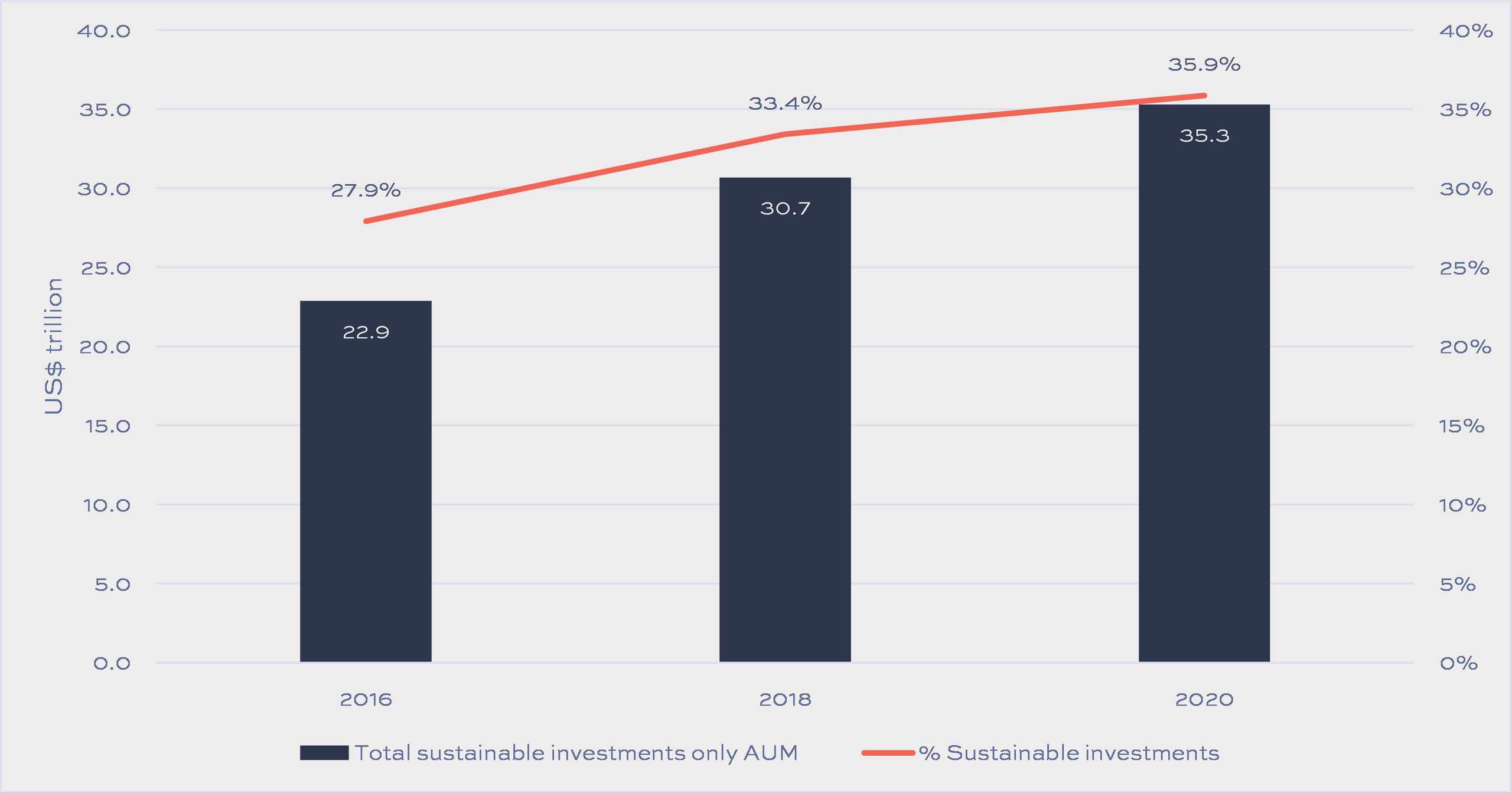

The initiatives of Tobacco Free Portfolios have taken place in the context of a broader trend of ESG or sustainable investing and the significant growth in the proportion of global assets under management dedicated to sustainable investing strategies. According to the Global Sustainable Investment Review, US$ 35.2 trillion or 36% of assets under management (AUM) across five regions covered by the report, were allocated to these strategies in 2020.

Figure 2: Global Sustainable Investing Assets

Source: Global Sustainable Investment Review 2020

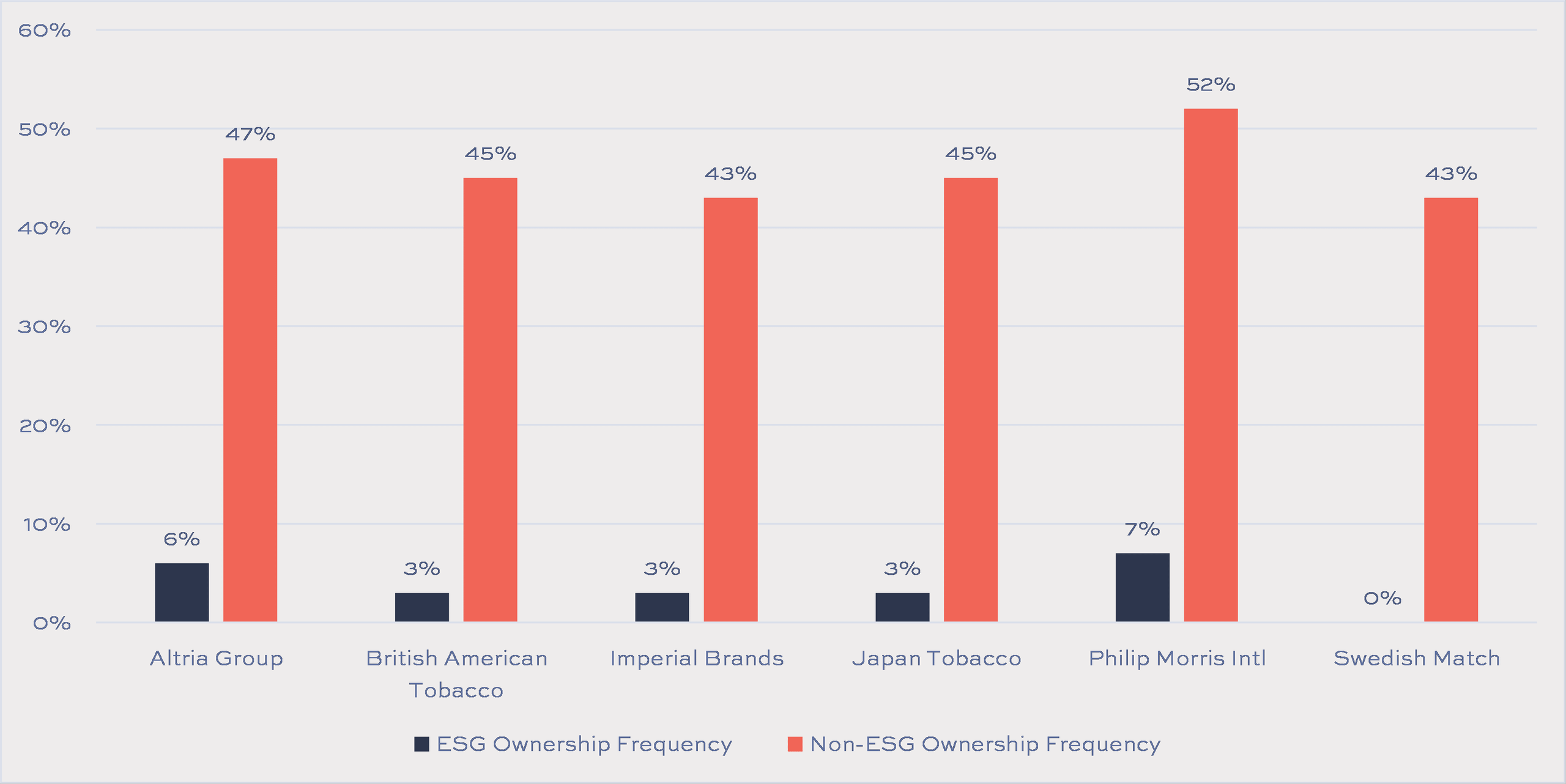

ESG investing is far from a settled discipline, and not all ESG funds exclude tobacco. However, according to an article by Morningstar, “What’s Really Inside Equity ESG Portfolios?”, the frequency at which tobacco stocks appear in ESG funds is substantially below their ownership by non-ESG funds.

Figure 3: Ownership Frequency of Major Tobacco Stocks

Source Morningstar Direct. Data as of 28 February 2022.

As the proportion of assets under management (AUM) invested in ESG strategies continues to rise, there is a growing need for funds to stand out from one another and have access to a broader range of investment opportunities. This will likely necessitate the use of more advanced exclusion criteria that go beyond simply excluding entire sectors.

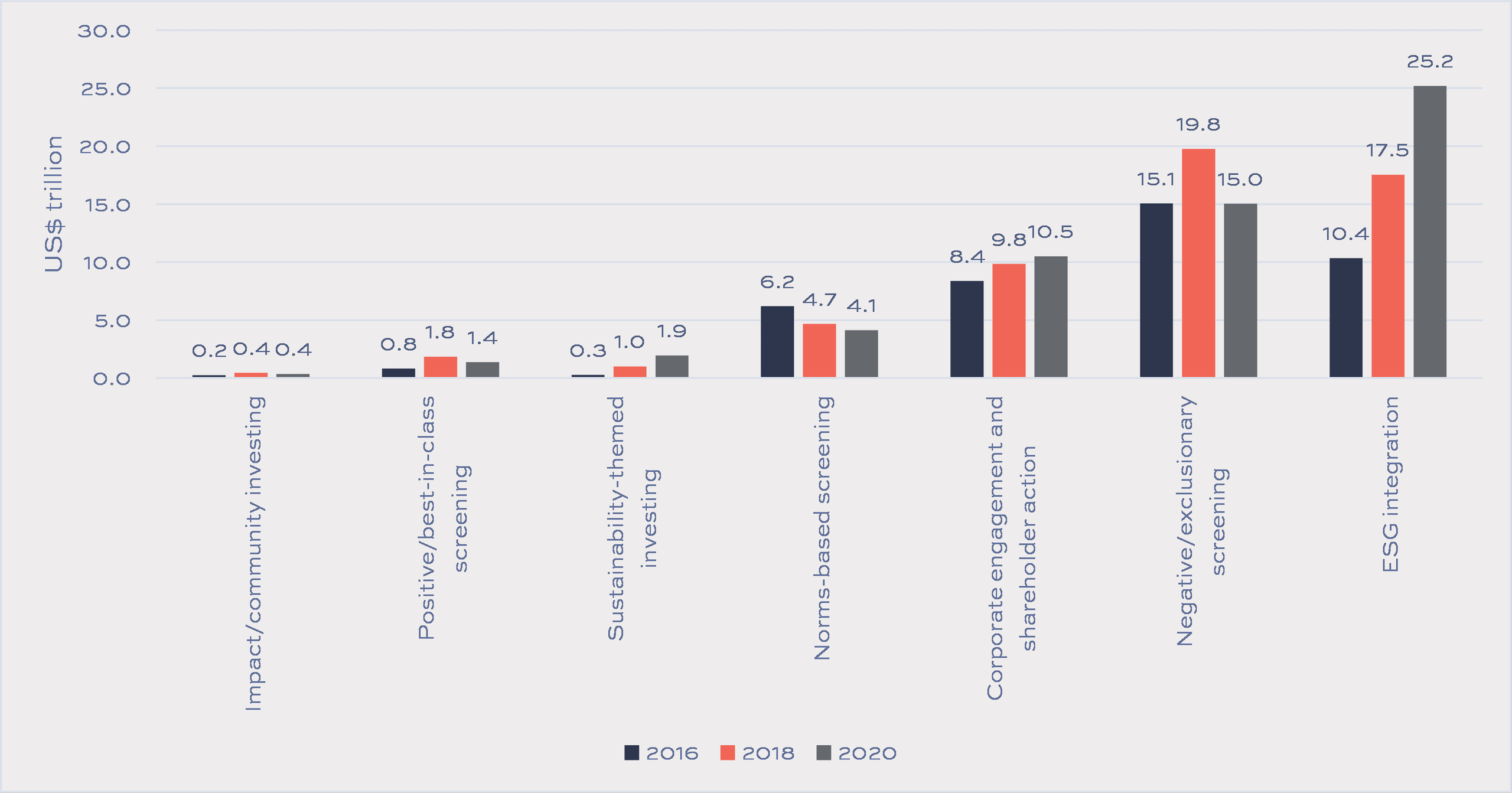

Whilst it may be unrealistic to anticipate significant changes in the attitudes of most ESG investors towards tobacco in the near future, and before considering the potential impact of more advanced exclusion criteria, there exist ESG approaches that could contemplate the inclusion of tobacco companies that are dedicated to, and implementing change. In this regard, we refer specifically to the expanding area of “Corporate engagement and shareholder action,” which had AUM of US$10.5 trillion in 2020 and “Positive/best-in-class screening” with AUM of US$1.4 trillion (see Figure 4).

Figure 4: Global Growth of Sustainable Investing Strategies 2016-2020

Source: Global Sustainable Investment Review 2020

The Index draws on other tools which have helped increase awareness and drive corporate action on key topics affecting their industries. It also builds upon the key tobacco-related areas and measures identified by other disclosure frameworks, such as the Sustainability Accounting Standards Board (SASB) Tobacco Standard.

Furthermore, by evaluating performance and activity in multiple areas, the Index produces data that broadens the target investor audience beyond those primarily focused on revenue metrics and a framework for considering how investing in tobacco stocks can be considered in a sustainable / socially responsible manner. As such, we believe it can become a vital data source for ESG and all investors who require objective and transparent information. It should be a focus area for the tobacco industry to expand its potential investor base.

For further reading related to this topic, readers may be interested in a blog post from the Foundation for a Smoke-Free World by David Janazzo, entitled “Tobacco And ESG Exclusions – A Contrarian View”.

Idwala Research Limited produced these reports and Excel tools pursuant to a professional services agreement with the Foundation for a Smoke-Free World, Inc. The opinions expressed herein are the author’s sole responsibility and under no circumstances shall be regarded as reflecting the positions of the Foundation for a Smoke-Free World, Inc. Pieter Vorster, Managing Director of Idwala Research Limited, served on the Index Technical Committee for the 2022 Tobacco Transformation Index.