Growth at risk?

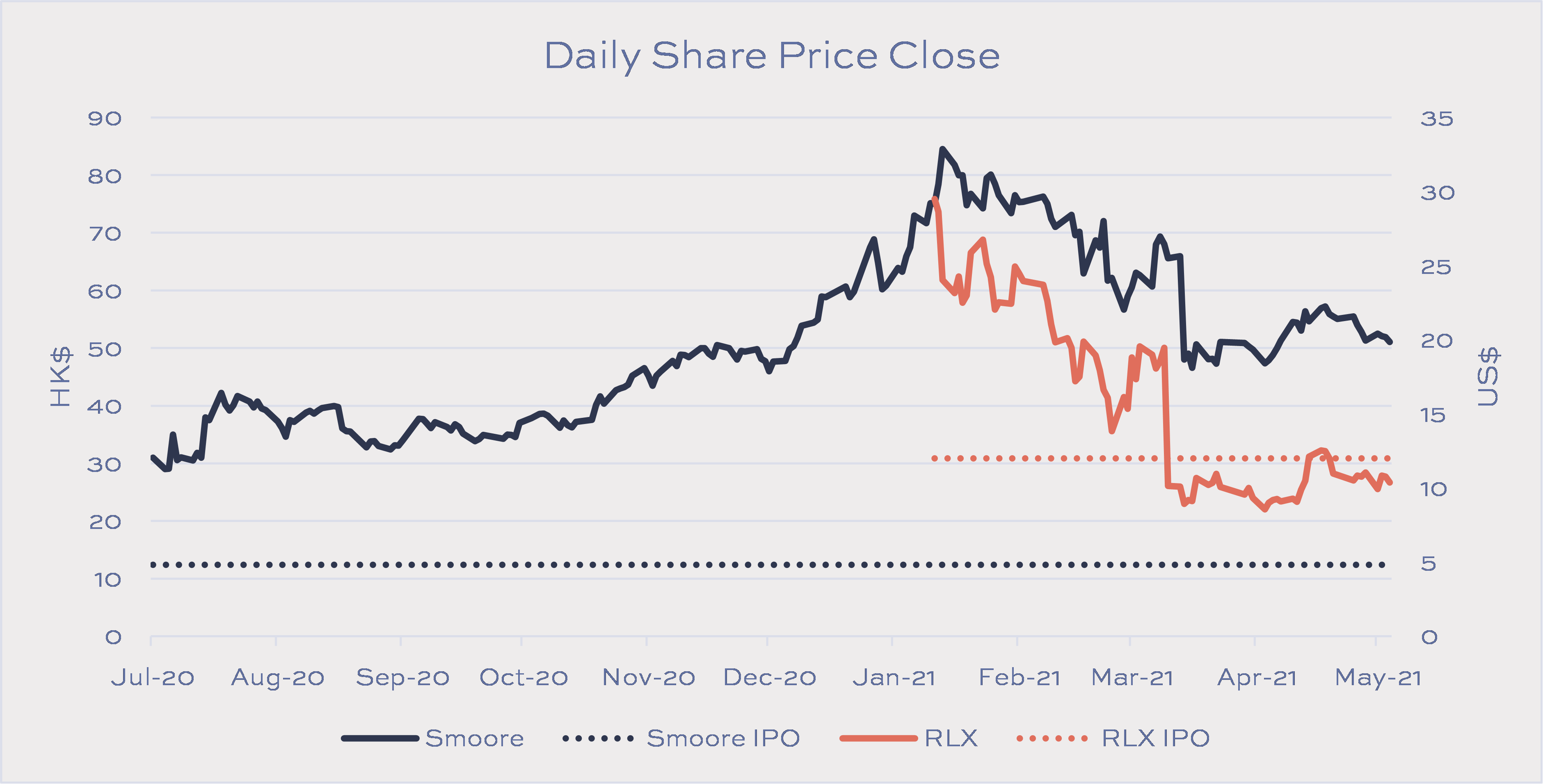

When the Chinese Ministry of Industry and Information Technology (MIIT) and the State Tobacco Monopoly Administration announced in March that they intended to include e-cigarettes and other new types of tobacco products in the regulations that govern cigarettes, the share prices of RLX and Smoore declined by 48% and 27% on the news. Whilst both stocks have clawed back some of these losses, RLX remains below its IPO price of US$12 per share set in January. Smoore, on the other hand, still trades at more than 4x its HK$12.4 IPO price.

How important it is to have a clear handle on regulatory risk is amply illustrated by these substantial moves - RLX's market value declined by US$14.6bn and Smoore's by US$13.7bn. In our previous blog post, idwala.co.uk/blog/unambiguous-investor-support-for-thr, we highlighted this risk and wrote the following:

"Tobacco taxes are an important contributor to the state and account for some 6% of fiscal revenue. When JUUL attempted to enter the market in 2019 through online store openings, internet sales of vaping products were banned promptly by the State Tobacco Monopoly Administration (STMA). The STMA also governs the China National Tobacco Corporation (CNTC), which enjoys a virtual monopoly in China. There appears to be a higher than average risk that disruptive products that threaten both excise tax revenues, and those of the CNTC, potentially face further regulatory pressure and product taxes.

It is clear that for investors in RLX, these risks are far outweighed by the revenue potential that could come from disrupting a $250bn+ p.a. industry."

The proposed regulations would have a profound impact on the nascent Chinese vaping industry as it currently exists. If the rules are applied to vaping products as they are to cigarettes, it would mean that their production and sales would be separated. Approved manufacturers would sell their agreed production volume to China Tobacco at a set ex-factory price. China Tobacco would set product standards, and all raw materials and components would need to be approved by it. Furthermore, excise taxes will be equalised. In short, the vaping industry in China as we know it will no longer exist if reduced-harm products are taxed and regulated like cigarettes.

Sadly, China is not the only market where a desire to protect government revenues fuels a significant and rising regulatory burden for reduced-harm products. Regrettably, this can be done under the guise of protecting public health, encouraged by the abstinence-based approach propagated by the WHO and supported by the likes of Bloomberg Philanthropies, the Campaign for Tobacco-Free Kids and the Truth Initiative.

Notwithstanding

this, investors appear to believe that the potential rewards outweigh the risks.

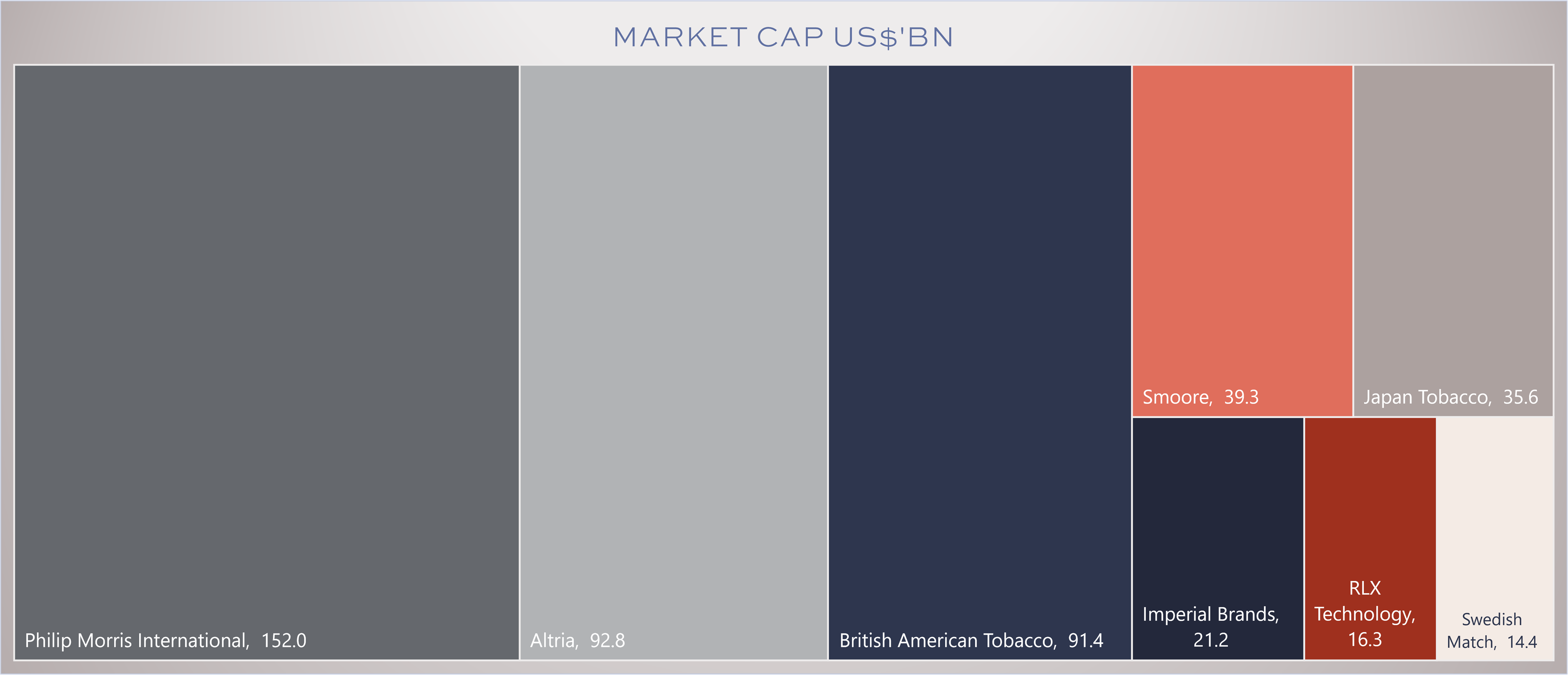

Even after declining nearly 50% on the Chinese regulatory news, RLX is still

valued at $16bn, or 0.8x Imperial Brands. In 2020, RLX's revenues were $585m -

just more than 5% of Imperial's.

Whether this risk assessment is accurate remains to be seen. Still, investors are taking a positive view on the long-term cash flow potential of reduced-harm products and, by implication, the future of tobacco harm reduction.