Tobacco Transformation Index - The Next Eight

We have published a third report in the series that takes an in-depth look at the 2022 Tobacco Transformation Index.

- Underlying Score and Score Change Drivers of the Top Seven.

- Peer Comparison of Top-Ranked Companies.

- Underlying Score and Score Change Drivers of the Next Eight.

The three reports and Excel tools aim to help investors and companies navigate the large dataset underlying the 2022 Tobacco Transformation Index to gain insight at a granular level into:

- why a company attained the score and ranking that it did,

- how these changed from the 2020 Index publication,

- and where the most feasible opportunities for score and ranking improvement and, by implication, transformation are.

A clearer understanding of the underlying drivers of the Index rankings and scores should lay the groundwork for more robust engagement between companies and investors on the topic of transformation based on objective data. Furthermore, increased and well-informed engagement with the Index will ultimately improve its utility for all stakeholders and help accelerate Tobacco Transformation and its underlying goal, Tobacco Harm Reduction.

How are the Next Eight different?

There are marked differences between the Top Seven Index companies, which were analysed in the first of this series of reports and the Next Eight, which we cover in this report.

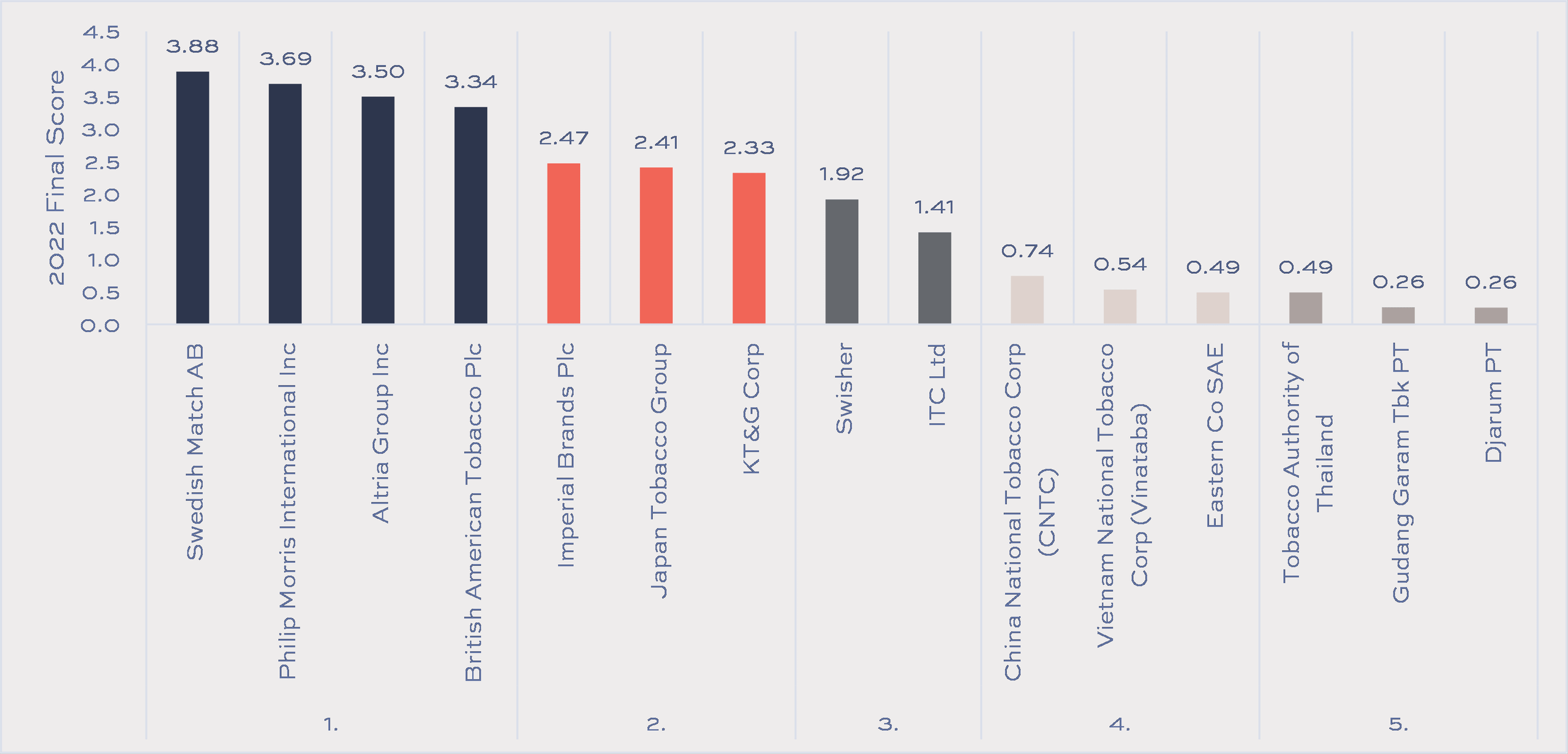

The 2022 Tobacco Transformation Index identified five broad behavioural pattern clusters around which the 15 Index Companies appear to be grouped (Figure 1).

- Strategic commitment & execution: Swedish Match, Philip Morris International (PMI), Altria, and British American Tobacco (BAT).

- Limited strategic commitment & execution: Imperial, Japan Tobacco Group (JT), and KT&G.

- No strategic commitment but limited execution: Swisher and ITC.

- Potential for change: China National Tobacco Corp (CNTC), Vietnam National Tobacco Corp (Vinataba) and Eastern Co SAE (Eastern).

- No indication of change: Tobacco Authority of Thailand (TOAT), Djarum PT (Djarum) and Gudang Garam Tbk PT (Gudang Garam).

Figure 1: Index Company Behavioural Pattern Clusters

|

|

Source: Tobacco Transformation Index

The Top Seven Index Companies are all publicly listed. They are grouped in the top two behavioural clusters identified by the Index and shown above: “Strategic commitment & execution” and “Limited strategic commitment & execution”. Their behaviour has largely been driven by fewer consumers willing to consume harmful combustible tobacco products and a robust and ongoing regulatory response aimed at significantly curtailing consumption. Furthermore, the investment community has increasingly shunned them on ESG grounds, with remaining investors valuing combustible tobacco as an industry in terminal decline.

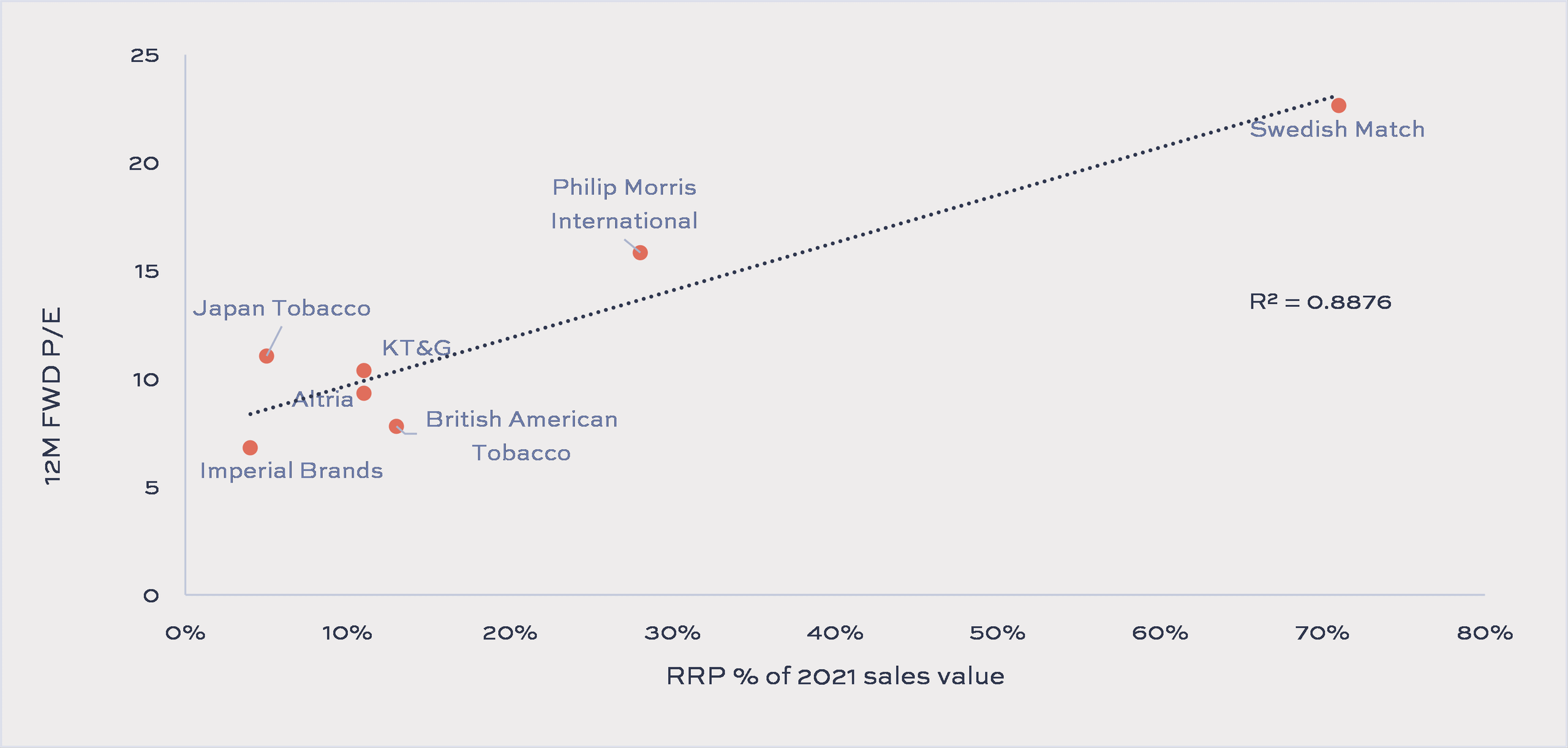

The significant growth of reduced-risk tobacco products (RRPs) over the past decade has introduced both a disruptive threat and a growth opportunity to the industry. Those who invest in it have increasingly differentiated industry participants based on the extent to which they have introduced RRPs into their businesses. Figure 2 shows the P/E valuation multiples of the Top Seven Index Companies against the contribution from RRPs to 2021 sales revenues. There has been a clear incentive for these companies to embrace RRPs and transformation and for investors to encourage them to accelerate the process.

Figure 2: 12-month forward P/E v. RRP contribution to 2021 sales value

|

|

Source: Tobacco Transformation Index, Idwala Research. Priced as of close 10 February 2023. Swedish Match share price and estimates as of 30 December 2022. Swedish Match was acquired by Philip Morris International, effective 30 December 2022.

The ownership and geographical structures of the Next Eight Index Companies differ markedly, not only from the Top Seven, but also from one another.

- Seven of the eight companies operate primarily in one country (predominantly Low-Medium Income Countries (LMICs)),

- four are state-owned or controlled,

- three are listed (including Gudang Garam, which is privately controlled and Eastern, which is state-controlled)

- three are privately owned or controlled,

- and only one can be regarded as a multinational.

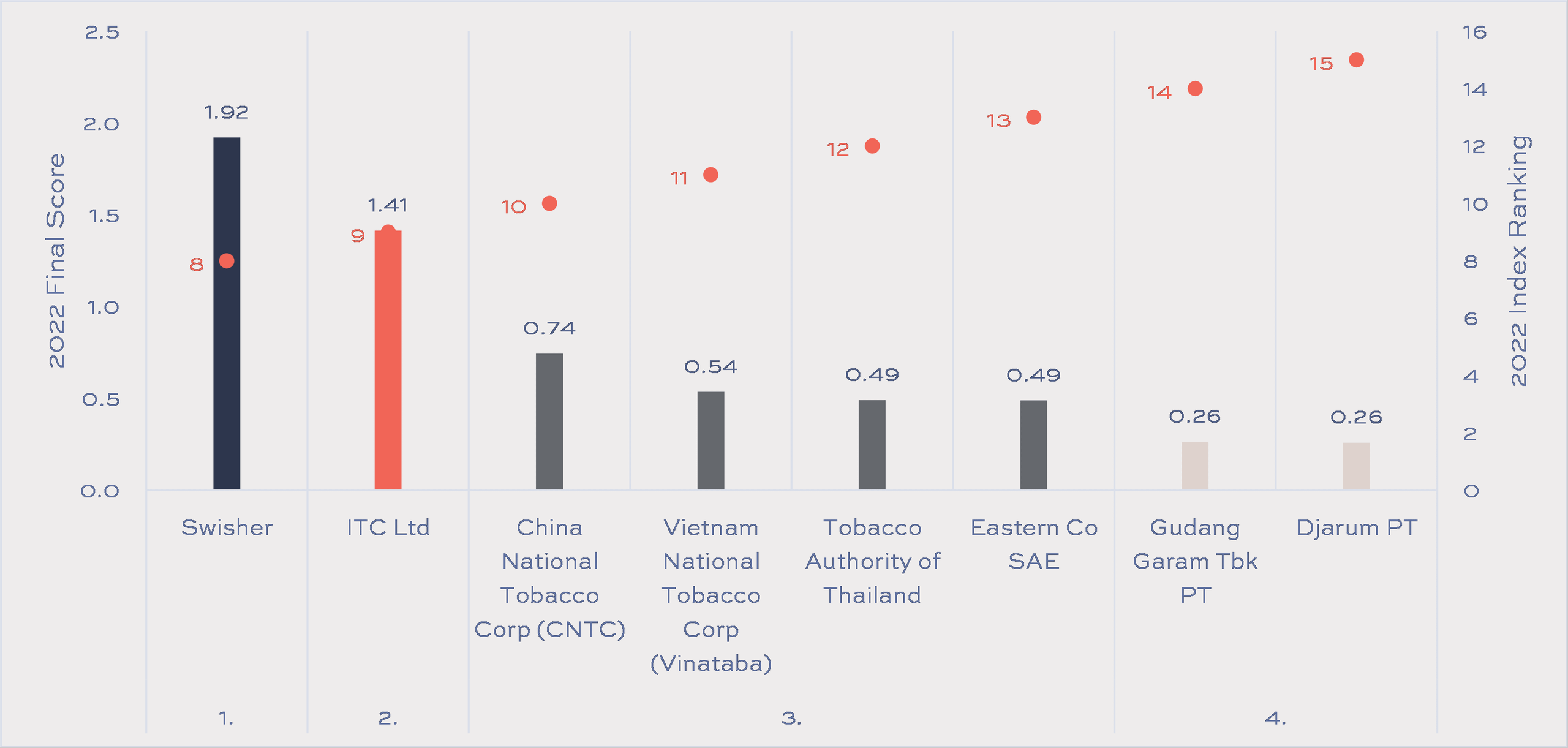

We have identified four broad categories of ownership and geographic exposure (Figure 3) :

- Private – Multinational: Swisher (18 of the 36 Index countries – top five markets are the US, South Africa, Japan, the UK and India).

- Listed - Predominantly single country: ITC (India)

- State-owned/controlled - Predominantly single country: CNTC (China), Vinataba (Vietnam), TOAT (Thailand) and Eastern (Egypt).

- Privately owned/controlled - Predominantly single country: Gudang Garam[1] (Indonesia) and Djarum (Indonesia)

Figure 3: Next Eight Ownership and Geographical Exposure Categories

|

|

Source: Tobacco Transformation Index, Idwala Research

In our view, several, often interlinked, factors affect the ability and motivation of the Next Eight to transform: ownership, regulation, relative product pricing and market structure. The Index website provides comprehensive information on company ownership, regulation and market structure of the 15 companies and 36 countries covered by the Index.

· Many LMICs have adopted the WHO’s prohibitionist approach to tobacco control/harm reduction and have either banned or placed severely restrictive regulations on RRPs. Heated tobacco and vaping products are banned in India and Thailand, and according to press reports, Vietnam’s Ministry of Health has proposed a ban on all “new tobacco products”.

· The WHO’s stance on RRPs has, in our view, enabled governments with significant ownership of their tobacco industries to protect these businesses against the disruptive threat posed by RRPs.

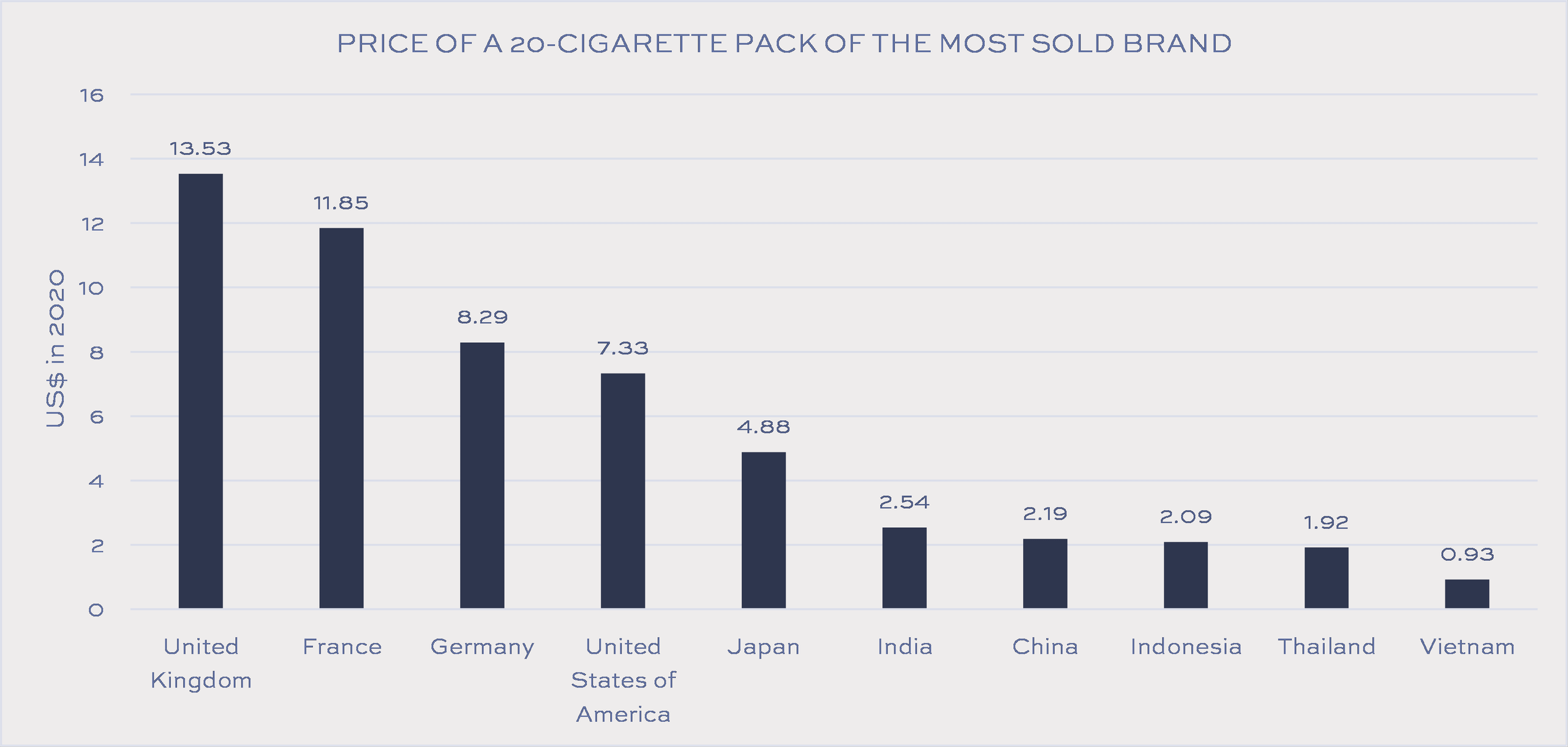

· One of the most significant barriers to harm reduction in developing countries is the cost of RRPs compared to cigarettes. Figure 4 shows the 2020 prices of the most popular cigarette brand in US$ for selected countries. Low cigarette prices make RRPs uncompetitive owing to their relatively high manufacturing costs.

· Privately owned companies are not exposed to the scrutiny of and valuation by public markets and may not introduce transformation with the same sense of urgency as the listed peers. However, their businesses will ultimately be subject to the same valuation criteria.

Figure 4: Selected 2020 cigarette price comparisons

|

|

Source: WHO

Whilst the Next Eight Index companies may currently be less inclined or able to embrace tobacco harm reduction, increased awareness of the health risks associated with smoking will ultimately impact the sustainability of their business models, regardless of their ownership, regulatory or market structures. Being scored and ranked publicly on their harm reduction progress should provide incremental motivation, at least for some.

Report Structure

This report, Underlying Score and Score Change Drivers of the Next Eight, analyses the underlying score drivers of the eight Index companies that make up the bottom three behavioural clusters of the 2022 Tobacco Transformation Index and how these changed from 2020 to 2022. We look at the following:

- The category contributions to each company’s Final Score, change in Final Score and rankings, and

- The indicator contributions to weighted scores, score changes and rankings for each category and company.

Idwala Research Limited produced these reports and Excel tools pursuant to a professional services agreement with the Foundation for a Smoke-Free World, Inc. The opinions expressed herein are the author’s sole responsibility and under no circumstances shall be regarded as reflecting the positions of the Foundation for a Smoke-Free World, Inc. Pieter Vorster, Managing Director of Idwala Research Limited, served on the Index Technical Committee for the 2022 Tobacco Transformation Index.

[1] Although Gudang Garam is listed, 75.9% of its stock is held by its founding family