Unambiguous Investor Support for THR

The highly successful listing of RLX last week and continued appreciation in Smoore's valuation shows ongoing and growing investor appetite for reduced-risk nicotine product businesses.

It provides an enticing opportunity for inventors and entrepreneurs to raise capital and accelerate new product development. On its own, this process could serve to quicken the pace of tobacco harm reduction by delivering more satisfying alternatives to smokers at lower prices.

But a meaningful increase in the quality, variety and availability of reduced-risk products would also raise the threat of disruption and likely speed up the tobacco industry's transformation. The somewhat eye-watering valuation multiples achieved by Smoore and RLX should provide further motivation and could see shareholders becoming more vocal supporters of transformation.

RLX and Smoore

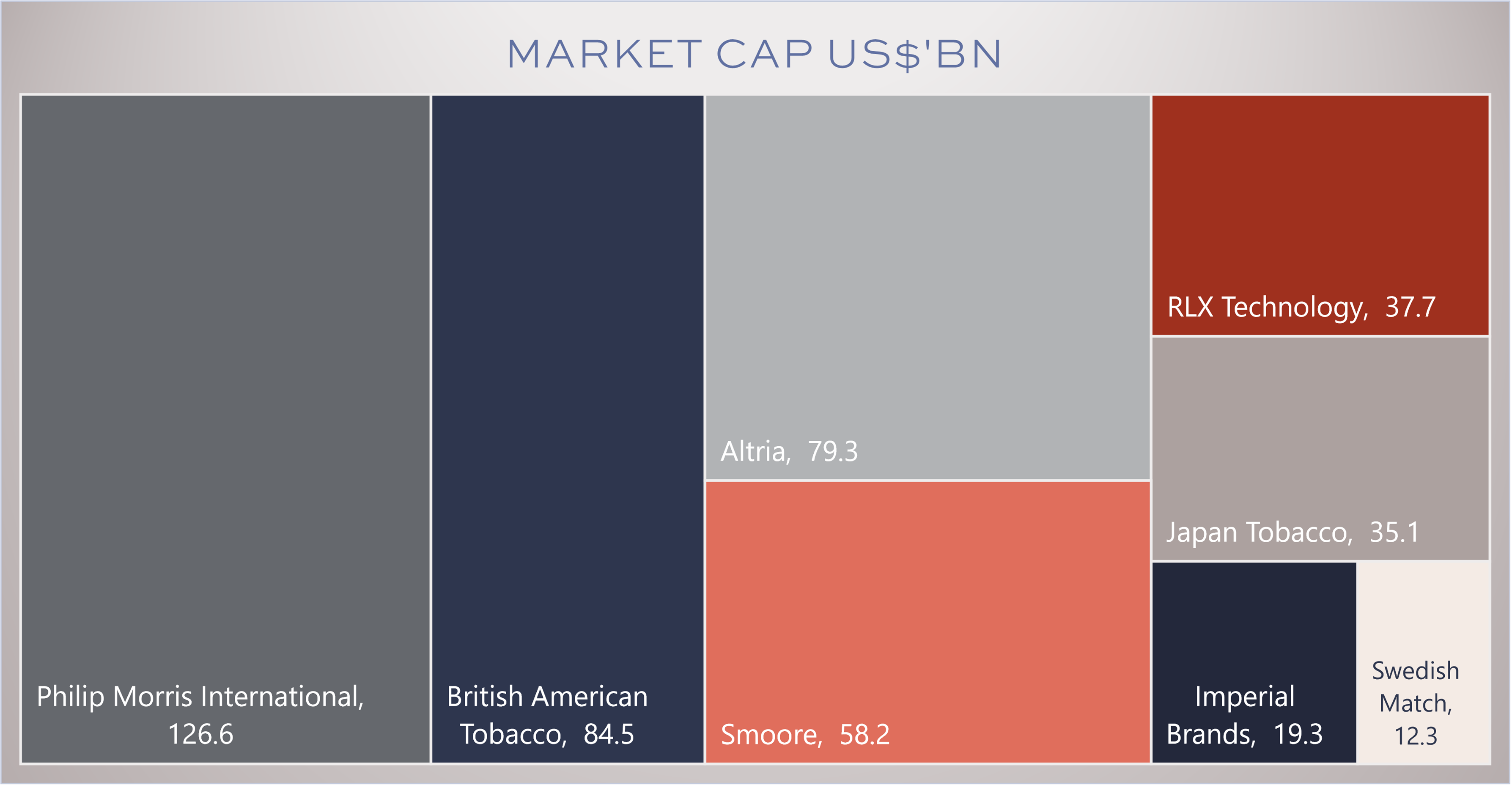

RLX Technology Inc. listed on NASDAQ on 22 January 2021 after raising US$1.4bn of new equity at $12 per share, valuing the company at US$18.6bn. At its current share price of US$24.3, RLX is valued at US$38bn, twice the market value of Imperial Brands and 1.1x Japan Tobacco.

Smoore International Holdings, which was valued at US$9.2bn at IPO on 19 July 2020, is currently trading at 6.2x its IPO price and valued US$58bn. Together, the two stocks are worth some US$96bn; nearly 30% of the US$357bn total market cap of PMI, BAT, Altria, Japan Tobacco, Imperial Brands and Swedish Match.

To put these valuations into perspective, readers should consider that the six tobacco stocks listed above, are forecast to show aggregate 2020 sales revenue of some US115bn and operating profit of c.$47bn. By comparison, Smoore and RLX's combined 2020 revenue is unlikely to exceed US$2bn (1.7% of the tobacco group) with operating profit likely under US$600m (1.3% of the tobacco group). Smoore is valued at more than 35x 2020E sales and RLX well over 70x.

China could be a highly desirable market for reduced-risk products

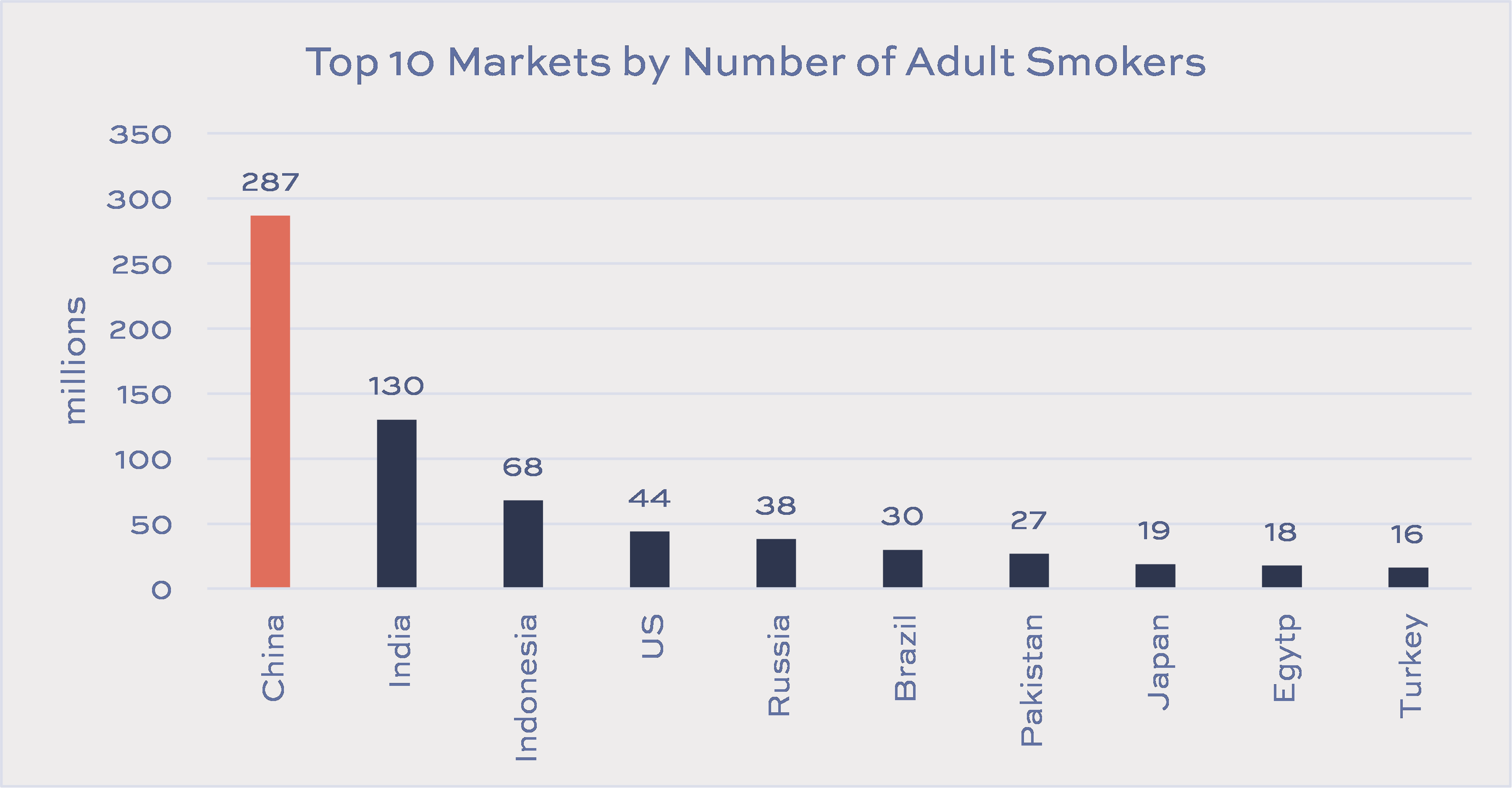

RLX dominates the nascent Chinese vaping market and, in theory, China could become the most attractive global market for reduced-risk products. At 290m, China has by far the highest number of smokers in the world.

While China holds much promise as a market for reduced-harm products, progress has been slow. These products are estimated to have generated retail sales of only US$2.5bn in 2020, compared with US$254bn for combustible tobacco products.

Tobacco taxes are an important contributor to the state and account for some 6% of fiscal revenue. When JUUL attempted to enter the market in 2019 through online store openings, internet sales of vaping products were banned promptly by the State Tobacco Monopoly Administration (STMA). The STMA also governs the China National Tobacco Corporation (CNTC), which enjoys a virtual monopoly in China. There appears to be a higher than average risk that disruptive products that threaten both excise tax revenues, and those of the CNTC, potentially face further regulatory pressure and product taxes.

It is clear that for investors in RLX, these risks are far outweighed by the revenue potential that could come from disrupting a $250bn+ p.a. industry.